Hello there.

Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best of finance from last week. Friday, we’ll cover tech, and next Monday, we’ll tackle policy.

This week, we’ve got…

🧈 Is This the End of a 100-Year Cycle?

🚪 What’s Behind Door Number 2?

⚡️ Finance Quick Fix

🎭 Winners & Losers

😆 Meme of the Week

📈 Top Stock Ideas

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates at FinanceWrapped.com.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with Longview Tax

Outdated tax tools drain time, increase audit risk, and limit strategy. In this on-demand webinar, see how Longview Tax helps you cut manual work, boost accuracy, and get back to what matters most.

Please support our partners!

🧈 Who Doesn’t Want to Revisit the Gilded Age?

Private credit has ballooned into one of Wall Street’s favorite playgrounds, and Fitch Ratings is worried it could turn into a wrecking ball during the next downturn. Private credit refers to loans made by non-bank lenders (think asset managers and private equity firms) directly to companies that can't or won't borrow from traditional banks. Fitch flagged “bubble-like” traits for the industry: too much leverage, too many retail investors piling in, and too much creativity in how deals are structured.

At the same time, the AI boom is leaning harder on borrowed money. From CoreWeave’s massive cloud deals to Oracle’s infrastructure bets, debt is becoming the fuel for data center expansion. Private equity shops like Vista Equity are even underwriting debt for their own portfolio companies, squeezing fees out of a sluggish M&A market.

The warning lights are flashing. Private credit could magnify the next financial shock, and insurers are piling in like it’s the 1920s. If you’re chasing returns in private credit or debt-heavy tech, make sure you’re ready for the downside when leverage cuts both ways.

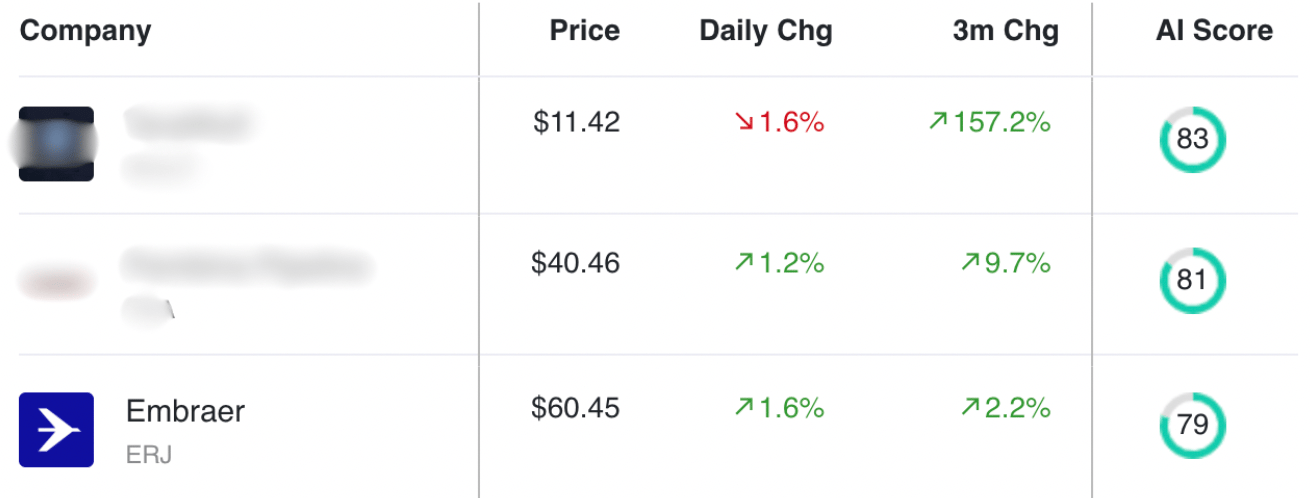

See AltIndex’s Newest Top 3 Overall Stock Picks

Things are going crazy in markets right now. It feels like opinions vary wildly and the macro (and micro) signals are all over the place.

And yet, AltIndex’s top stock picks beat the S&P 500 by almost 40% over the past 6 months.

And in the midst of all this market chaos, AltIndex’s AI model has been consistently rating these three stocks as “buys” for almost two months. Now, they’ve risen to the top-rated spot across the whole platform.

AltIndex’s AI is constantly updating its stock ratings based on the freshest alternative data mixed with rigorous technical analysis. We are always intrigued when any stock is recommended for any length of time, as that typically means it’s showing strength consistently and in several different areas.

One of them is Pembina Pipeline. See the other two here, and get seven more stocks with a free 7-day trial of the app:

🚪 Knocking on New Investment Doors

Vanguard, long the anti-crypto holdout, is considering letting its 50 million clients trade Bitcoin and Ether ETFs. With $11 trillion in assets, a green light would mark one of the biggest shifts yet in mainstream access to digital assets.

For retail investors, that means crypto exposure could soon be as easy as buying an S&P 500 ETF. Vanguard doesn’t run its own crypto funds, but opening the platform to others would be a massive endorsement of the sector’s staying power.

Meanwhile, the Trump administration is exploring equity-like stakes in critical minerals producers, including Australian miners. The goal is to secure supply chains for national security, but it also shows that the government is willing to act like a shareholder. That could reshape valuations in mining stocks and ETFs tied to rare earths and battery metals; certainly something to keep an eye on.

🎭 Winners & Losers

A lot can happen in a week!

Let’s take a quick look at who struck gold and who struck out since our last issue:

🏆 Winners

Taiwan Semiconductor (TSM): +1.95%

NVIDIA Corporation (NVDA): +1.72%

Tesla, Inc. (TSLA): +1.50%

Berkshire Hathaway Inc. (BRK.A): +1.07%

Microsoft Corporation (MSFT): +0.30%

😞 Losers

🫡 Meme of the Day

📈 Stock ideas

Analysis provided by altindex.com.

Remember to always DYOR.

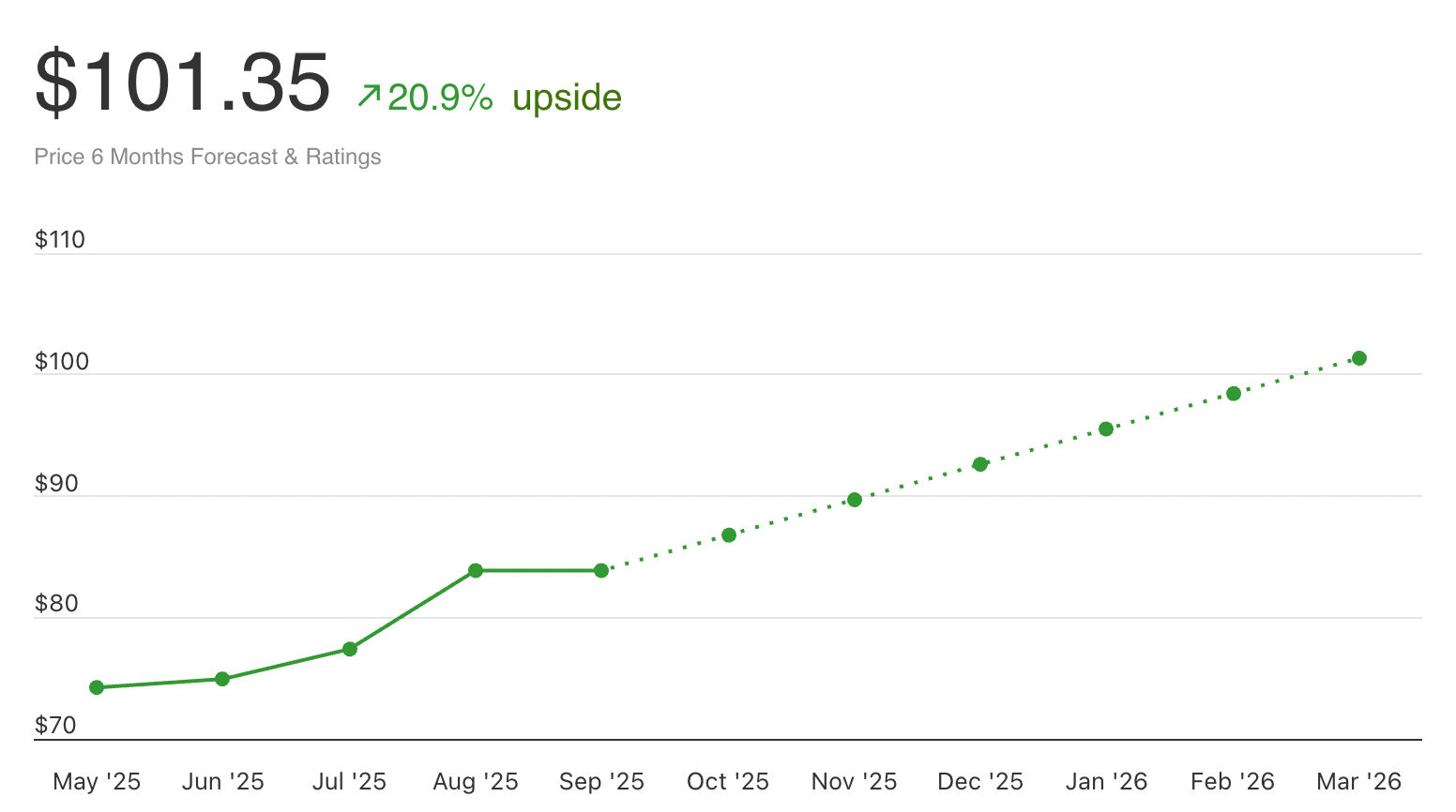

Cameco $CCJ

Cameco Corporation, a leader in uranium mining, refining, conversion and fuel manufacturing, is a Canadian public company that deals with advanced exploration and development projects. As a key player in the nuclear energy sector, the company is poised to benefit from the increasing global demand for cleaner energy sources.

The signals:

Revenue: $877M. That’s a 11.09% increase QoQ and a 46.55% increase YoY

Net income: $321M. Up 359.96% QoQ and up 791.11% YoY

Short- and long-term positive price trend, but RSI is overbought @ 82.7

Over the past few months:

28% increase in web traffic

10% decrease in job postings

87% positive employee outlook

Current price: $83.43

Target price: $101.35

Credo Technology $CRDO

Credo Technology Group Holding Ltd provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

The signals:

Revenue: $223M. Up 31.20% QoQ and 273.57% YoY

Net income: $63M. Increased 73.28% QoQ and 764.56% YoY

Positive short- and long-term price momentum, but SMA10 is down

P/E ratio is very high at 200.01

Over the past few months:

17% decrease in job postings

89% positive employee outlook

6% increase in Twitter followers

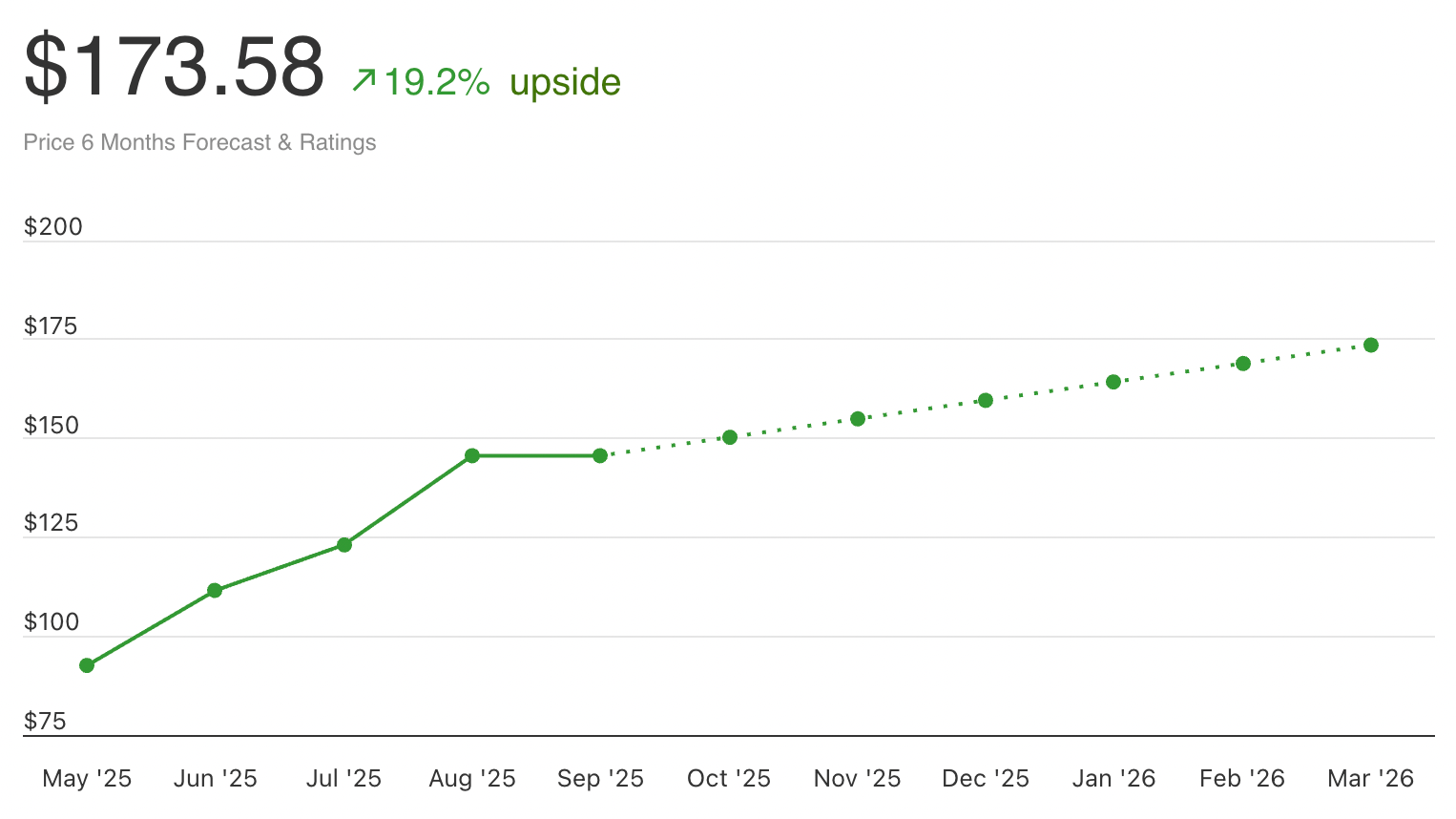

Current price: $142.21

Target price: $173.58

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake of Invested Inc.

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.