Hello there.

Hundreds of investing and finance newsletters hit our (and maybe your) inboxes every week. This is the best of the best of policy from the past week. Every Wednesday, we’ll wrap up finance, and every Friday, we’ll take on tech.

This week, we’ve got…

💊 GLP-1s Are Looking Thinner

⚡️ The Policy Pulse

🤔 “The Economy's On Fire”… Like In a Good Way, or…?

₿ The Coin Toss

😆 Meme of the Week

🏛 Political Portfolio Spotlight: Rep. Tim Moore (R-NC)

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates at FinanceWrapped.com.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with Westbound & Down

Winning “Brewery of the Year” Was Just Step One

Coveting the crown’s one thing. Turning it into an empire’s another. So Westbound & Down didn’t blink after winning Brewery of the Year at the 2025 Great American Beer Festival. They began their next phase. Already Colorado’s most-awarded brewery, distribution’s grown 2,800% since 2019, including a Whole Foods retail partnership. And after this latest title, they’ll quadruple distribution by 2028. Become an early-stage investor today.

This is a paid advertisement for Westbound & Down’s Regulation CF Offering. Please read the offering circular at https://invest.westboundanddown.com/

Please support our partners!

💊 Big Bets Are Back, Doctor’s Orders

Novo Nordisk just got the green light for its Wegovy weight-loss pill, giving the pharma giant a crucial first-mover advantage over rival Eli Lilly. The news was a shot in the arm for investors after a brutal year that saw the stock get cut in half.

Speaking of big swings, President Trump announced a new line of "Trump-class" warships, and critics aren’t impressed. Defense experts immediately called the idea a strategically obsolete "bomb magnet" that will likely never sail.

These high-stakes gambles are playing out as the Fed tries to figure out what AI will do to the economy. The person steering that ship will be the next Fed Chair, and Governor Christopher Waller's "strong interview" with Trump suggests the focus is shifting to the job market.

❓ What do you think?

⚡️ The Policy Pulse

Mickey Mouse, Betty Boop, the Marx Brothers, and Agatha Christie works are joining the public domain in 2026.

A red-hot M&A market had dealmakers working through the holidays, with $463.6 billion in mergers announced in December alone.

Trump's White House ballroom project heads to its first public hearing on January 8, giving commissioners a chance to question the controversial plans.

The Trump administration is asking the wealthy for donations to "Trump accounts" to supplement taxpayer contributions.

A US private equity firm prevailed in a German arbitration dispute, winning a tribunal ruling that requires B&C-Gruppe to pay over $43 million.

🤔 New Jenga Economy Just Dropped

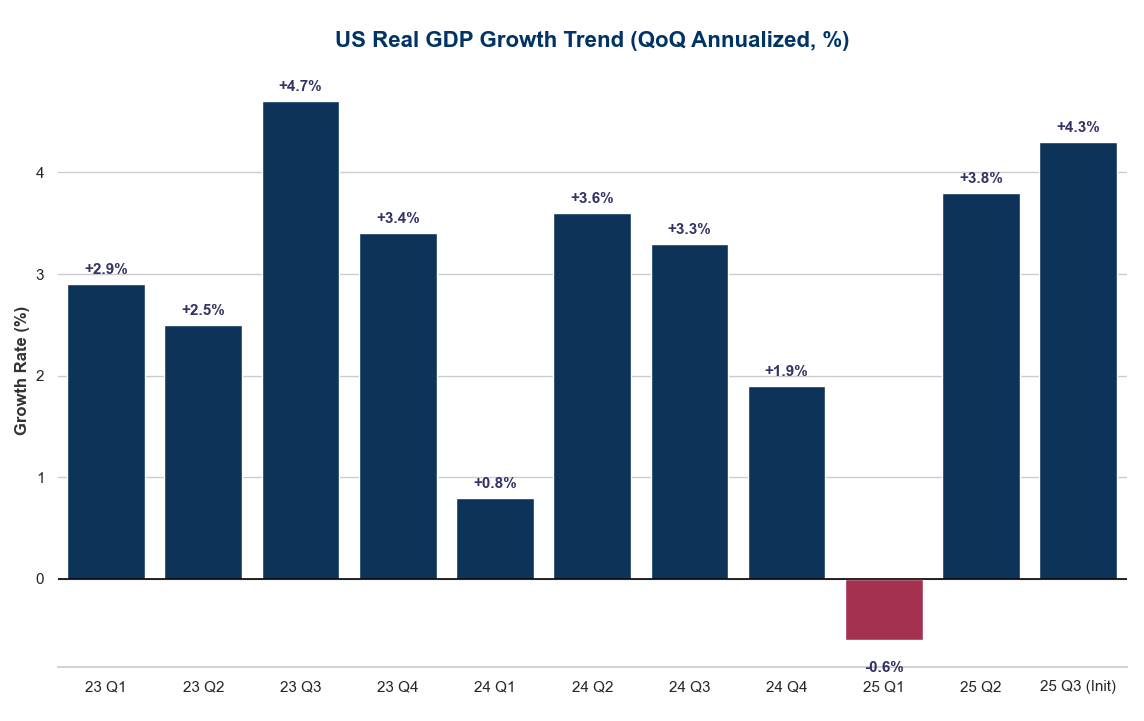

The US economy just dropped a 4.3% Q3 growth number, absolutely smoking expectations. The cause? Shoppers are spending like it's their job, boosting consumer outlays by 3.5%.

This has put the Trump administration in the awkward position of having to sell voters on an economy that looks great on paper but feels shaky on the ground. The strange gap between the spreadsheets and the streets suggests investors should watch consumer sentiment as closely as the headline numbers.

A little relief is showing up at the gas pump, with prices hitting four-year lows just in time for the holidays. But with businesses pulling back on equipment borrowing, the picture for 2026 is anything but clear.

₿ The Coin Toss

Crypto ETFs are set to explode in number throughout 2026, with analysts forecasting over 100 new filings and between $15 billion and $40 billion in net inflows.

Aave founder Stani Kulechov denied claims that he purchased $15 million of AAVE tokens to influence a controversial DAO vote.

Crypto M&A hit a record $8.6 billion in 2025, up from $2.17 billion in 2024, as Trump's embrace of the sector drove 267 deals.

Trust Wallet users lost more than $7 million following a hacked Chrome extension, with the breach affecting version 2.68 of the browser extension.

Bitcoin stumbled below $87,000 as gold, silver, copper, and platinum soared to new records. Bitcoin miner stocks fell 5 percent or more.

😆 Meme of the Week

🎙 Tell Us Your Thoughts

⭐️ What did you think of today's edition?

🏛 Political Portfolio Spotlight

Elected officials have had a tremendous amount of success in the market recently.

We want to keep you updated on what they’re trading and when so you can leverage that intel as you plan out your own portfolio.

Data provided by AltIndex.

Remember to always DYOR.

Rep. Tim Moore

(R-NC)

💲 Top Trades This Week:

🔍 Analysis:

Moore logged a mixed set of trades centered on consumer discretionary and legacy industrial exposure. The most notable activity was Cracker Barrel, where he both sold a larger block and then re-added shares (suggesting that he might be swing trading the stock!).

On the buy side, Verizon and Harley-Davidson point to a tilt toward established, cash-generating brands tied to yield and discretionary consumer spending rather than high-growth tech. Meanwhile, the six-figure sale of Hyster-Yale stands out as a decisive reduction in industrial exposure following continued underperformance.

Overall, the moves suggest portfolio cleanup and rebalancing. He may be trimming struggling industrial bets while selectively rotating into consumer-facing names with brand durability and income characteristics.

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake with Invested Inc.

Disclosures:

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance does not guarantee future results.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.