Hello there.

1 million new starter homes built and sold under an affordable rent-to-own program. Wow, what an idea! Somebody should write that down.

🏠 Trump Steaks, Trump University, Trump... City?

⚡️ Who Wants to House-sit All This Nuclear Waste?

📉 Hire, Fire, or Hold, Gentlemen. Place Your Bets.

₿ BlackRock Is Dumping Bitcoin on the Sly

🏛 Political Portfolio Spotlight: Rep. Sheldon Whitehouse (D-RI)

But until they do, it’s just another dangled carrot. Let’s get after it.

WARNING: These AI Stocks May Cause Massive Wealth

|

Side effects may include:

✔ Checking your brokerage account obsessively

✔ Screaming "I KNEW IT!" at your spouse

✔ Googling "what to do with my fortune" at 3 a.m.

Because when Alex Green—yes, the guy who nailed Nvidia at $1.10 per share split-adjusted—says he believes these 7 AI stocks are about to explode…

This isn't meme stock madness or crypto roulette.

It's seven real companies with trillion-dollar potential combined— but you must act before Wall Street fully catches on.

Find out how to get the list before your barista retires before you.

Please support our partners!

🏠 A Million Trump Homes in a Housing Hail Mary

Homebuilders are making affordable housing sound patriotic! A coalition including Lennar Corp. is pitching a plan to develop up to 1 million homes branded as "Trump Homes," targeting first-time buyers who've spent the last five years watching Zillow like it's a horror movie. The proposal involves private investors financing the construction while tenants rent for three years, with monthly payments counting toward a down payment if they decide to buy.

The numbers are bonkers. We're talking over $250 billion in housing activity, which would be the most coordinated residential push since suburbs were invented. Entry-level inventory has been missing from the market for a decade, and builders finally realized they can't keep selling $600,000 "starter homes" to people making $75,000 a year. Only 17% of voters think now is a good time to buy, down from 69% in 2013. It doesn’t take a genius to see there’s a structural problem.

But there’s also a catch: FHFA Director Bill Pulte already told Fox Business the administration isn't actively looking at the proposal, though they're open to ideas. Translation: this “program” lives in PowerPoint for now. Details around financing, investor risk, and rent-to-own mechanics remain fuzzy enough to keep the lawyers employed for a while yet. Still, the fact that builders are pitching solutions this ambitious tells you exactly how desperate the push for affordability has become.

❓ What do you think?

Will housing crash in the next 5 years or nah?

In partnership with Vintage Funds

Invest in recession-resilient Mobile Home Parks with Vintage Capital

Invest in recession-resilient Mobile Home Parks with Vintage Capital. Invest direct or in a fund of 20+ underlying assets. 1031s are also available. Access stable, income-generating properties with consistent demand and low tenant turnover.

Now is the time to act: Current market conditions are creating opportunities to acquire properties at attractive valuations.

Our fund targets a 15%-17% IRR and makes monthly distributions, which provides a steady income stream alongside strong upside potential and tax-efficient benefits.

Why Mobile Home Parks?

Recession-Resilient: Affordable housing demand drives stable returns in any economy

High Tenant Retention: The average MHP tenant stays 10-12 years (compared to 2-3 in Multifamily)

Proven Expertise: $100MM+ track record in mobile home park investments.

Tax-Smart Investing: Bonus depreciation offers tax advantages.

Please support our partners!

⚡️ The Policy Pulse

Novo Nordisk said it will sue Hims & Hers after the telehealth provider announced a $49 copycat of Novo's $149 Wegovy weight loss pill.

The US government is asking states to volunteer to host nuclear facilities and data centers on college campuses in permanent waste disposal facilities.

Participation in corporate DEI disclosures fell 65% among Fortune 500 companies, as political backlash continues to accelerate the corporate retreat.

Stellantis took a $26 billion write-down on EVs, with its CEO saying the charges reflect "overestimating the pace of the energy transition".

The Milan-Cortina 2026 Winter Olympics returns to Europe for the first time since 2014, with organizers hoping to capitalize despite a budget that has ballooned from $1.3 billion to over $1.7 billion.

📉 Job Openings Softly Land on a 5-Year Low

The December JOLTS report dropped job openings to 6.5 million, the lowest level since September 2020 and roughly 1 million fewer than a year ago. Economists expected 7.2 million. They were off by a country mile. November's numbers were also revised down, because that’s just how we do things now.

The labor market has entered what economists politely call "low hire, low fire" mode. Hiring flatlined, but so have layoffs, for the most part. Nobody's getting axed, but nobody's getting hired either. Unemployment crept from 4% to 4.4% over 2025 without dramatic layoff headlines. The slow grind is doing the work that pink slips used to do.

The sector breakdown tells the story. Healthcare keeps carrying the economy (thanks, Boomers). Manufacturing, meanwhile, has shed jobs every month since March 2024. The Fed now has even more reason to stay patient on cuts while wage pressure fades and companies protect margins by freezing headcount instead of swinging. Quality balance sheets and pricing power start looking prettier when hiring freezes become the default corporate strategy… and, while the entirety of tech is chasing the AI ether, maybe a little bit of stagnation elsewhere is a good thing.

From last week’s issue:

₿ The Coin Toss

BlackRock's bitcoin fund hit a $10 billion volume record as heavy redemptions point to institutional capitulation near recent lows.

Bitcoin bounced from multi-year lows after the House narrowly passed a funding package to end the government shutdown.

Treasury Secretary Scott Bessent told Congress the US has no authority to "bail out" Bitcoin and won't direct private banks to buy more crypto.

Michael Burry warned that further Bitcoin declines could trigger a "death spiral" for Strategy and mining firms.

Crypto super PACs have stockpiled over $190 million ahead of the 2026 midterms, with Fairshake alone raising $133 million last year.

😆 Meme of the Week

🎙 Tell Us Your Thoughts

⭐️ What did you think of today's edition?

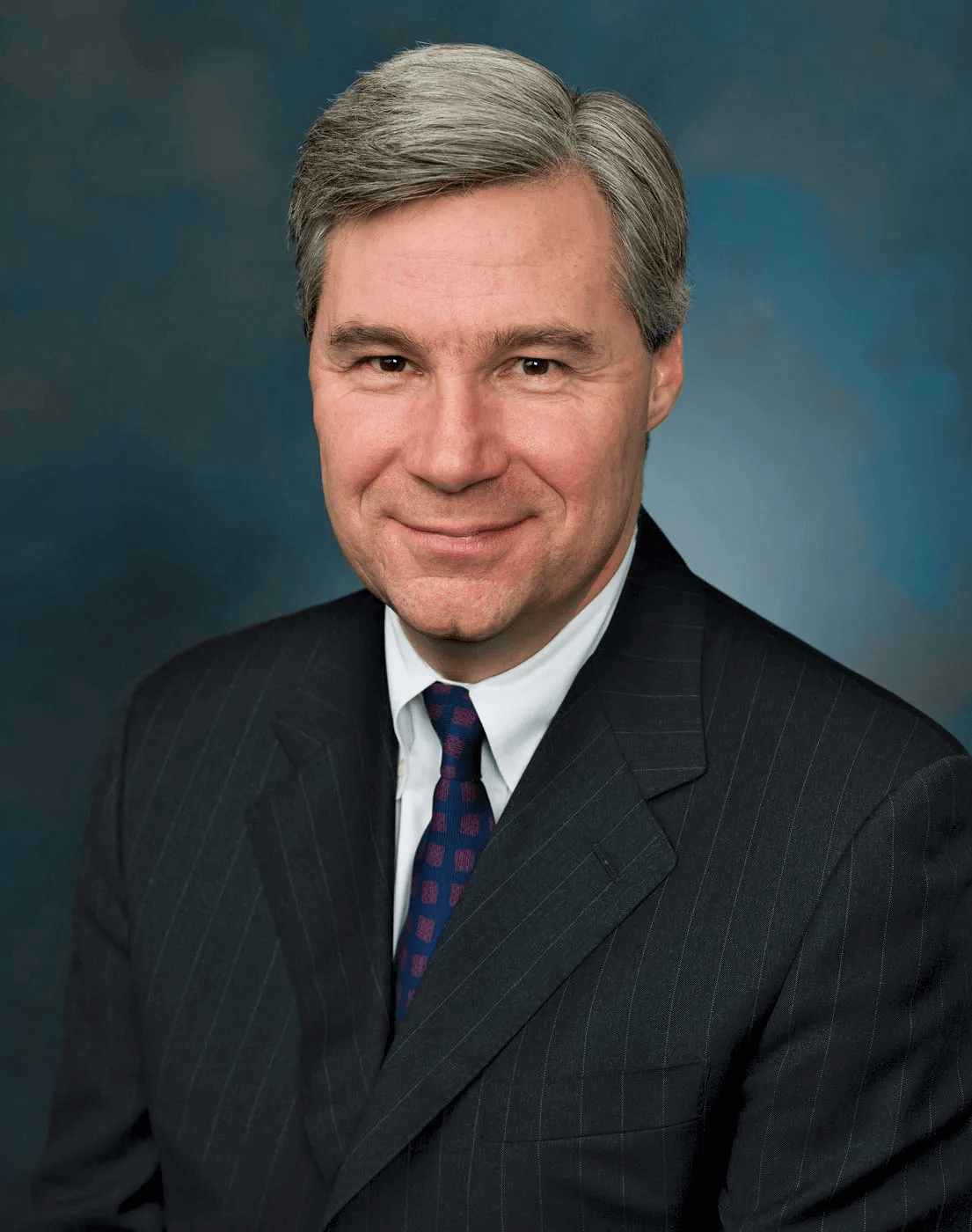

🏛 Political Portfolio Spotlight

Elected officials have had a tremendous amount of success in the market recently.

We want to keep you updated on what they’re trading and when so you can leverage that intel as you plan out your own portfolio.

Data provided by AltIndex.

Remember to always DYOR.

Rep. Sheldon Whitehouse (D-RI)

💲 Top Trades This Week:

[SELL] Home Depot, Inc. (HD)

[SELL] McDonald’s Corp. (MCD)

[SELL] NVIDIA Corp. (NVDA)

[SELL] Starbucks Corp. (SBUX)

🔍 Analysis:

Whitehouse’s recent disclosures show clean reductions rather than tactical reshuffling. Every reported action is a sale, with multiple full exits and modest partial trims, showing a deliberate exit rather than rotation into new exposure.

The most notable moves are the full sales of McDonald’s and Starbucks, effectively closing out consumer discretionary and consumer staples positions tied to brand-driven, inflation-sensitive demand. These exits suggest a conscious step away from companies where margin pressure, wage inflation, and slowing discretionary spend could cap near-term upside.

On the whole, Whitehouse’s recent action reads as risk reduction and cleanup, not reallocation. He’s lightening exposure, closing out mature positions, and locking in gains where valuations and macro crosscurrents justify caution.

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake with Invested Inc.

Disclosures:

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance does not guarantee future results.

Finance Wrapped, AltIndex by Invested Inc. (AltIndex LLC), Stocks & Income, The Chain, Future Funders, and Dinner Table Discussions are all owned by Invested Inc.