Hello there.

Wall Street ghosted its climate pledges, and half of those $100 million CEO pay packages have flopped. But on the back of broken promises, the old guard still isn’t willing to give up the ghost…

Surely, this will have no consequences:

🌍 When’s The Last Time You Heard About Ice Caps?

⚡️ Dimon Says, “Don’t Count Me Out”

💰 Moonshot Costs Eclipse Its Benefits

🎭 Winners & Losers

😆 Meme of the Week

📈 AltIndex’s Top Stock Ideas for the Week

Let’s get started.

In partnership with Capital Trends

This Space-Age Metal Discovery Could Break China's Grip

Fighter jets can't fly without it. Rockets can't launch. Nuclear submarines can't dive.

And Project Blue says that a supply squeeze is coming.

That's why Saga Metals' new discovery in Canada is turning heads.

Please support our partners!

🌍 Wall Street's Great ESG Retreat

Remember when Larry Fink wore that climate-themed scarf to Davos and declared BlackRock would reshape global finance to fight climate change? Turns out it was mostly cosplay 😂 Six years after Wall Street's grand promises to use $130 trillion in assets to “save the planet,” the movement has essentially collapsed.

Here's the speed run: In 2020, Fink kicked off the ESG craze after big clients (mostly European and Japanese pension funds) started asking for green investment products. BlackRock obliged, other banks followed, and by 2021, everyone from JPMorgan to Bank of America was pledging trillions in "sustainable finance." The Glasgow Financial Alliance for Net Zero racked up 450 members, and BlackRock alone pulled in $25 billion of new ESG money that year.

Then came the lawsuits, state investigations, and more than 100 bills designed to punish ESG-friendly firms. Politically-backed treasurers yanked over $1 billion from BlackRock. After Trump's 2024 reelection, almost every major American bank fled the Net-Zero Banking Alliance, which promptly folded. Bank of America walked back its coal and Arctic drilling restrictions. And Fink's latest investor letter featured a whopping zero mentions of climate change. And now… big banks and institutions seem to be realizing that unstable wind and solar energy can’t power AI data centers. The new narrative is nuclear energy.

The investor takeaway is straightforward. ESG as a broad narrative is getting buried, but clean energy investment still hit $279 billion last year. Companies that can play both sides (think nuclear, natural gas, even some renewables) might be the new sweet spot.

⚡️ Finance Quick Fix

Jamie Dimon joked he plans to stay JPMorgan CEO “at least” five more years, a familiar line that’s keeping succession chatter alive.

Roche’s Genentech upgraded its North Carolina manufacturing investment to $2 billion, adding to Roche’s broader $50 billion US investment.

Warren Buffett’s pledge to give away 99% of his wealth could eventually test Berkshire Hathaway’s defences against activist investors.

Netflix earnings are set to refocus investors on fundamentals after a sharp selloff, even as headlines swirl around its fight with Warner Bros. Discovery.

Estée Lauder was sued by a beauty tech startup alleging theft of proprietary technology, exposing fresh legal risk for the cosmetics giant.

💰 Moonshot Packages Mostly Crashed and Burned

If you've ever wondered whether paying a CEO nine figures makes shareholders rich, the data just came in. Spoiler: not really.

Of the 20 "moonshot" pay packages that companies handed out at the peak of the CEO megadeal fad (we're talking $100 million+ with ambitious performance targets), half were canceled or forfeited within a few years. Only a quarter of those companies managed to beat the S&P 500. Four packages did hit all their targets and soared close to $1 billion apiece, but that's four out of twenty.

For retail investors, this is a reminder to actually read the proxy statements on executive comp. If a company is handing out massive equity grants tied to targets that look more aspirational than achievable, that's capital being diluted from your pocket into someone else's. Companies where management owns real equity (bought with their own money, not just options) tend to care more about the stock price than those playing with house money.

🫡 Meme of the Day

📈 Stock ideas

Analysis provided by altindex.com.

Remember to always DYOR.

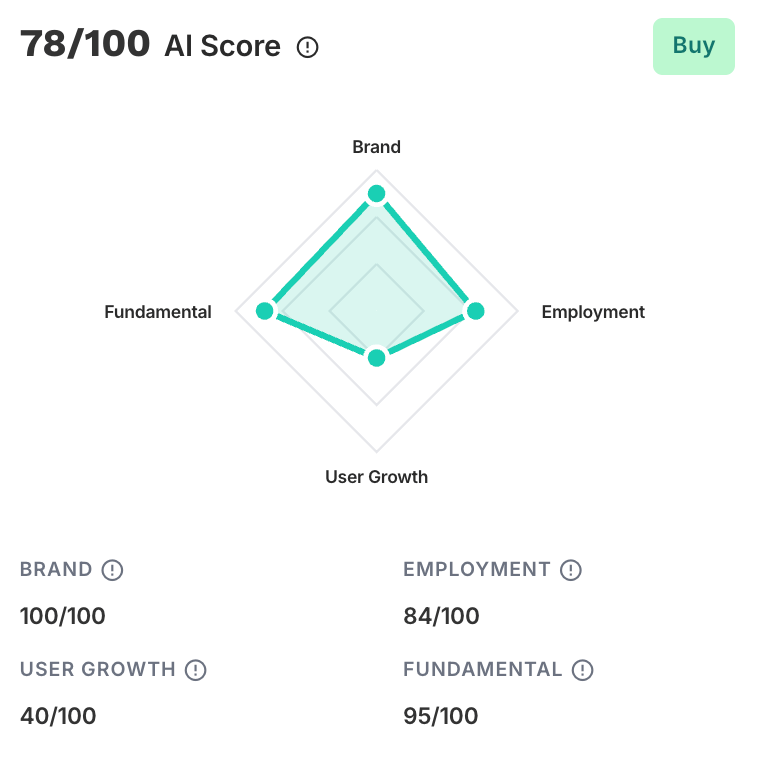

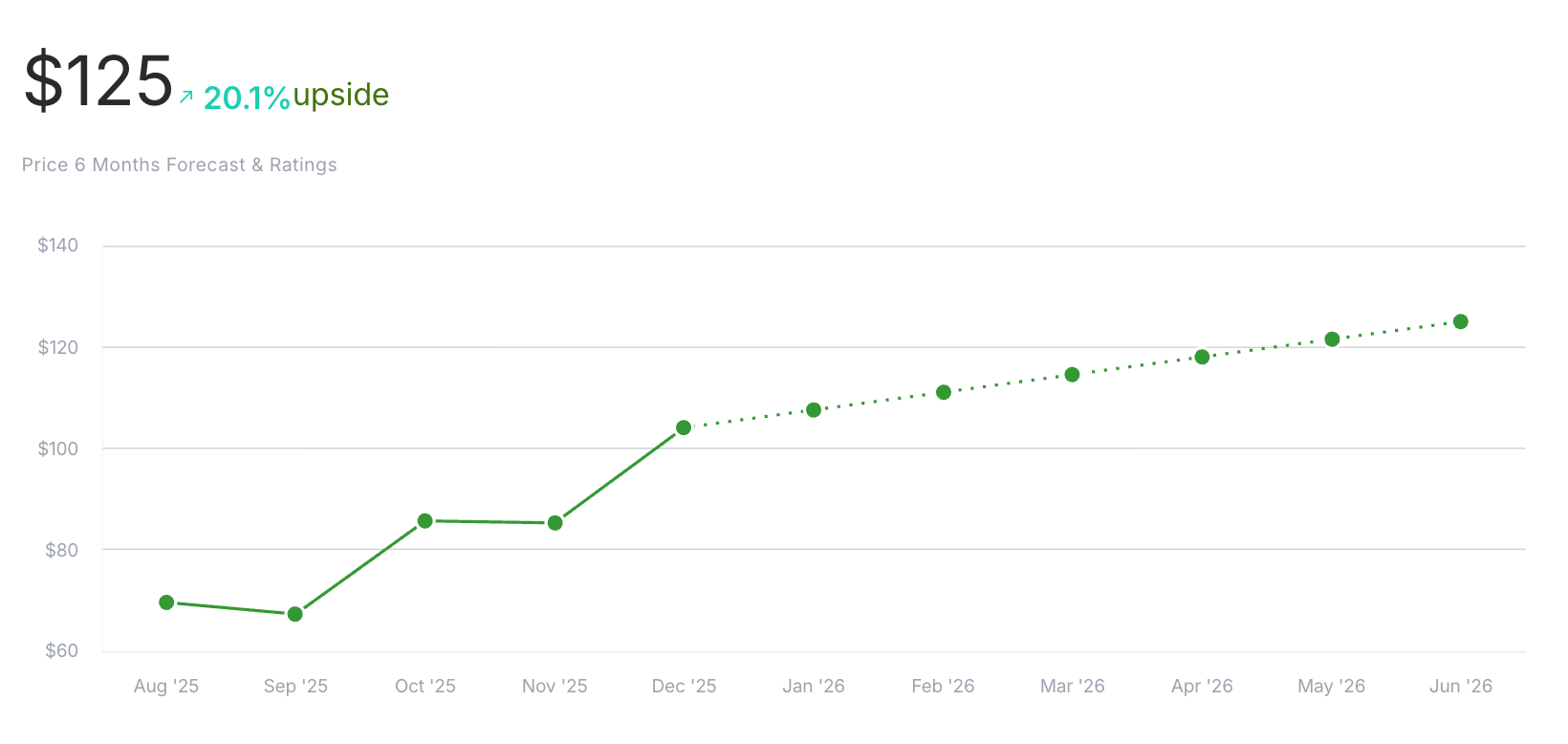

Anglogold Ashanti is a leading global gold mining company with a diverse portfolio of high-quality assets in key gold-producing regions across the globe. The company is committed to sustainable mining practices and aims to deliver long-term value to shareholders through operational excellence, cost management, and innovation. Anglogold Ashanti's operations are spread over ten countries, including significant properties in Africa, Australia, and the Americas.

The financial data:

Revenue: $2.42B. That’s an 1.15% increase since last quarter and a 62.11% increase since last year.

Net income: $669M. About the same as last quarter but up 200% year over year.

Price momentum: The stock is up 22.66% the past month and up 297.33% the past year.

RSI: Overbought territory at 89.2 (What is RSI?)

P/E: Normal at 21.72 (What is P/E?)

Alternative data over the past few months:

37% increase in Instagram followers

78% positive employee business outlook

18% decrease in web traffic

7.4% increase in Youtube subscribers

Current price: $103.60

Target price: $125

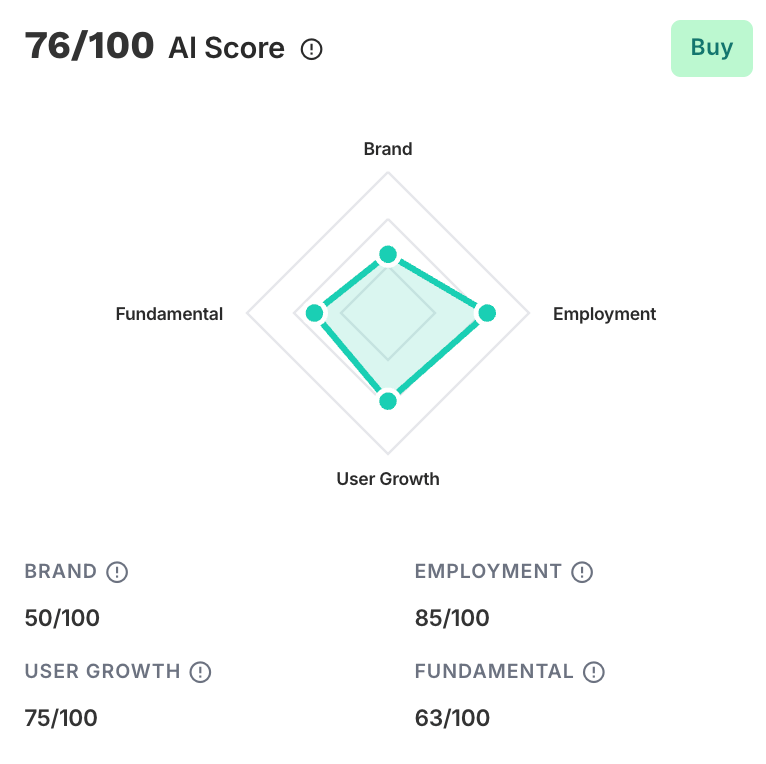

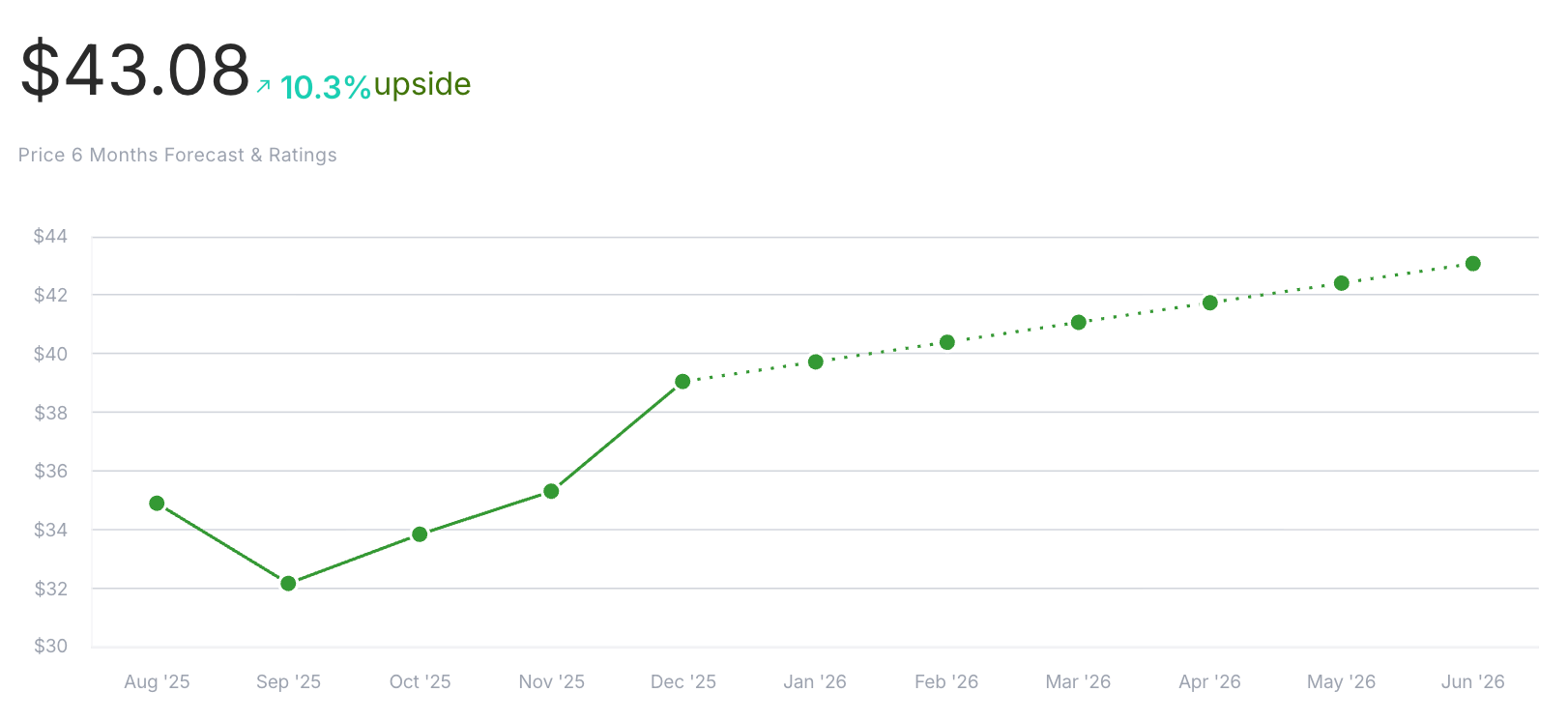

Atlantic Union $AUB

Atlantic Union is a regional financial services company operating primarily in the United States. The company provides a comprehensive range of services, including retail and commercial banking, investment banking, and asset management. With a significant market presence and a growing customer base, Atlantic Union is entrenched as a formidable entity in the financial services sector.

The financial data:

Revenue: $539M. Down 8.75% since last quarter but up 50.81% since last year

Net income: $92M. Increased by 365.57% over the past quarter and 20.58% year over year

Price momentum: The stock is up 5.96% over the past month and up 6.89% over the past year

RSI: Neutral at 54.4

P/E: Seems fairly valued at 21.54

Alternative data over the past few months:

62% increase in job listings

86% positive employee outlook (up 12%)

34% increase in web traffic

41% increase in Linkedin employees

6% increase in Youtube subscribers

Current price: $39.05

Target price: $43.08

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake of Invested Inc.

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Finance Wrapped, AltIndex by Invested Inc. (AltIndex LLC), Stocks & Income, The Chain, Future Funders, and Dinner Table Discussions are all owned by Invested Inc.