Hello there.

We went from shiny rocks to black rocks real quick. That’s ‘black rocks’, not ‘Blackro’—oh, forget it.

⛏️ Don’t Call it a Coalback (Sorry, I Know)

⚡️ Ketchup and Cheese Kiss and Make Up

🏠 This Winter’s Got Nothin’ On the Housing Market

₿ What Exactly Can You Buy with Crypto, Anyway? Oh…

🏛 Political Portfolio Spotlight: Rep. Sheldon Whitehouse (D-RI)

Alright, let’s get into it.

In partnership with Credit.com

Your credit could be costing you more than you realize.

When credit issues go unnoticed, the impact can show up in different ways — higher interest rates, fewer options, or missed opportunities.

With a free credit assessment from Lexington Law, America’s #1 credit repair law firm, you can see what may be affecting your credit and identify areas that could be holding you back. It’s a simple way to understand your credit picture. Better credit starts with real attorneys.

Please support our partners!

⛏️ Trump's Coal Comeback Tour

Remember how we were supposed to be heading towards a future that looked like a Windows Vista background, where everything runs on sunshine and peace? It doesn’t look like that’s super likely... This week, the president signed an executive order directing the Pentagon to buy electricity from coal-fired power plants, because nothing says "military readiness" like the dingy tech your great-grandparents used.

Here's the thing: coal currently provides about 16% of US electricity, down from over 50% in 2000. A 2023 analysis found that 99% of coal-powered facilities are more expensive to run than just replacing them with renewables. It’s a military move to make the US more fight-ready in case the worst happens, or really, in order to avoid war in the first place.

The Department of Energy is also throwing $175 million at upgrading six coal plants across West Virginia, Ohio, North Carolina, Kentucky, and Virginia. The Tennessee Valley Authority jumped on the bandwagon too, voting to keep two coal plants running that were scheduled for closure by 2035. Critics are calling it a taxpayer-funded bailout for an industry that the market has already rejected. Supporters are calling it "beautiful, clean coal," which is a phrase that makes about as much sense as "dry water."

The executive order lacks specifics on how much energy the Pentagon will actually purchase or at what price. So for now, it's more of a flex for the coal industry than a genuine market mover. Whether this can actually reverse coal's decline remains to be seen. The smart money says probably not.

❓ What do you think?

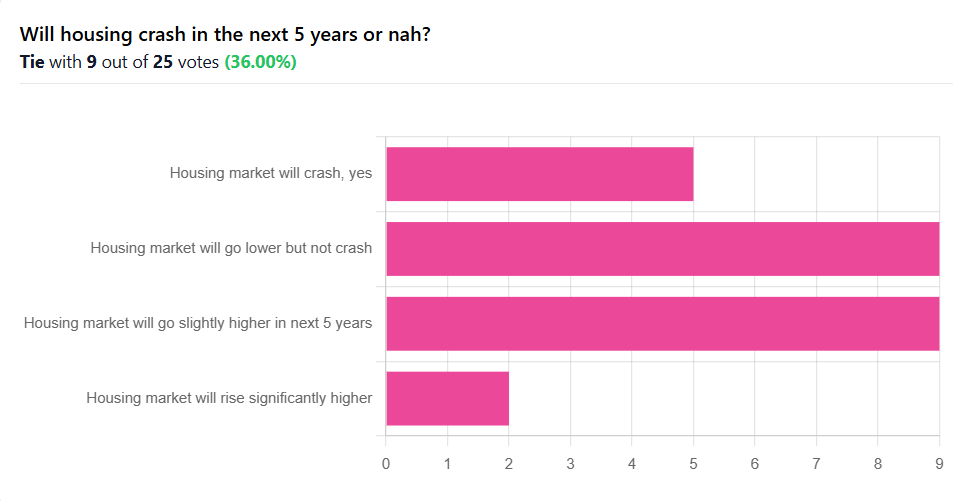

Will housing crash in the next 5 years or nah?

⚡️ The Policy Pulse

Kraft Heinz is pausing work on its planned split as new CEO Steve Cahillane says many of the company’s issues are “fixable”.

Trump tariffs have triggered a record $3.6 billion in customs bond shortfalls, with nearly 27,500 importers flagged.

Canada’s biggest institutional investors are rethinking their US exposure as dollar risk prompts major pension funds to hedge currency bets.

The Vatican Bank launched two Catholic-principles equity indexes, tracking 50 large-cap stocks aligned with church ethics.

Canadian investment in the US plunged 69% year over year in Q3 2025, growing cautious about locking long-term capital into US markets.

🏠 The Great American Housing Freeze

If you were hoping 2026 would be your year to buy a house, January's numbers just delivered a real downer. Existing home sales tanked 8.4% from December to an annualized rate of 3.91 million units. That's the biggest monthly drop in nearly four years and the slowest pace since December 2023.

The National Association of Realtors is calling it a "new housing crisis," which is market-speak for "Americans are stuck, and nobody's moving." The national median sales price climbed to $396,800, marking 31 consecutive months of year-over-year price increases. Affordable? You tell me. Prices have gone up, wages haven't kept pace, and inventory is still 40% below pre-pandemic norms.

Some analysts are blaming brutal winter weather for the slowdown, which is convenient but probably only part of the story. Mortgage rates did dip to 6.06% briefly in January before creeping back up, but that wasn't enough to get buyers off the sidelines. The real culprit is a market where homeowners with 3% mortgages refuse to sell into a 6% environment. Meanwhile, homes priced over $1 million were the only segment that actually grew compared to last year, while everything under $250,000 fell off a cliff.

First-time buyers represented 31% of purchases, up slightly from last year, but "slight improvement in a disaster" isn't exactly a win. Homes are sitting for 46 days on average now versus 41 days a year ago. Spring buying season is supposed to be the salvation here, but unless rates drop meaningfully or inventory materializes from thin air, expect more of the same.

From last week’s issue:

₿ The Coin Toss

Crypto flows to human trafficking networks surged 85% in 2025, though apologists say blockchain transparency could disrupt these operations.

Bitcoin jumped to $69,000 after US CPI inflation came in cooler than expected at 2.4%, though Fed rate-cut odds for March stayed below 10%.

A crypto CEO was sentenced to 20 years for running a $200 million Bitcoin Ponzi scheme that promised daily returns of up to 3%.

Steve Bannon and Trump advisor Boris Epshteyn were named in a class action lawsuit over their promotion of the "Let's Go Brandon" memecoin.

Kalshi partnered with sports insurance firm Game Point Capital to let teams hedge championship bonus payouts through prediction markets.

😆 Meme of the Week

🎙 Tell Us Your Thoughts

⭐️ What did you think of today's edition?

🏛 Political Portfolio Spotlight

Elected officials have had a tremendous amount of success in the market recently.

We want to keep you updated on what they’re trading and when so you can leverage that intel as you plan out your own portfolio.

Remember to always DYOR.

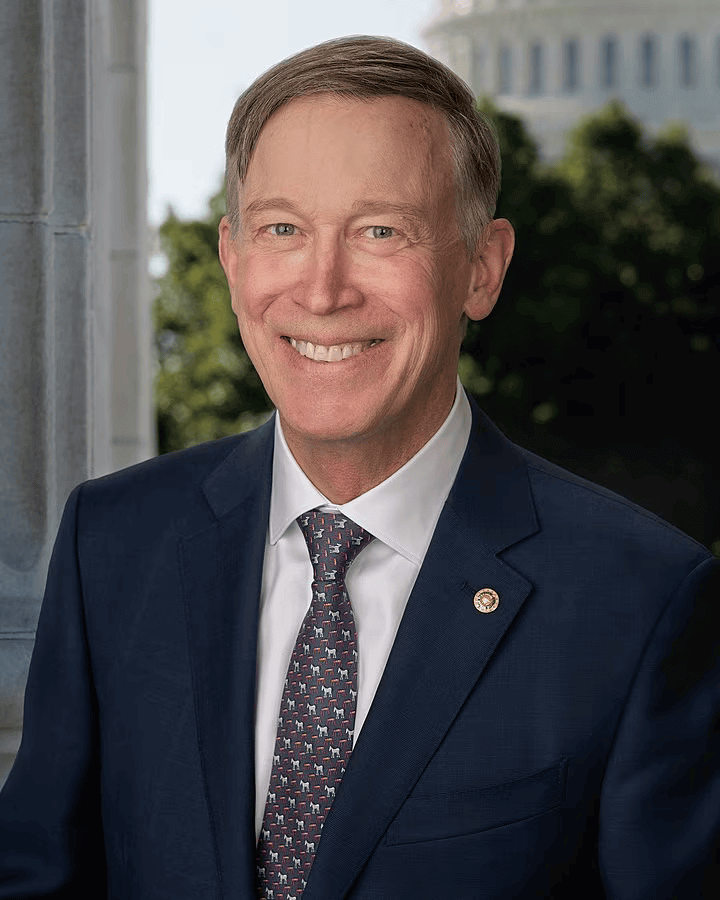

Sen. John W. Hickenlooper (D-CO)

💲 Top Trades This Week:

🔍 Analysis:

Hickenlooper’s latest disclosures reflect selective reallocation rather than broad de-risking.

The most decisive capital deployment is into Eaton, a power management and electrical systems manufacturer closely tied to grid modernization, electrification, and industrial buildout.

Overall, Hickenlooper’s activity reflects strategic reweighting: dialing back traditional brick-and-mortar exposure while increasing alignment with infrastructure electrification and digital mobility platforms. It’s thematic realignment toward sectors positioned for multi-year structural demand.

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake with Invested Inc.

Disclosures:

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance does not guarantee future results.

Finance Wrapped, AltIndex by Invested Inc. (AltIndex LLC), Stocks & Income, The Chain, Future Funders, and Dinner Table Discussions are all owned by Invested Inc.