Hello there.

Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best of tech from the past week. Every Monday, we’ll tackle policy, and every Wednesday, we’ll recap finance.

This week, on Tech Wrapped, we’ve got…

🤖 Amazon Thinks People Are Outdated

⚡️ The Tech Ticker

🔋 The Inconvenient Truth About Energy Supply

🤖 All Eyes on AI

😆 Meme of the Week

🎙️ Shadow Dockets and the Humanoids at Home

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates on Finance Wrapped.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with Rippling

Don’t get SaaD. Get Rippling.

Remember when software made business simpler?

Today, the average company runs 100+ apps—each with its own logins, data, and headaches. HR can’t find employee info. IT fights security blind spots. Finance reconciles numbers instead of planning growth.

Our State of Software Sprawl report reveals the true cost of “Software as a Disservice” (SaaD)—and how much time, money, and sanity it’s draining from your teams.

The future of work is unified. Don’t get SaaD. Get Rippling.

Please support our sponsors!

🤖 Big Tech's Labor Reckoning

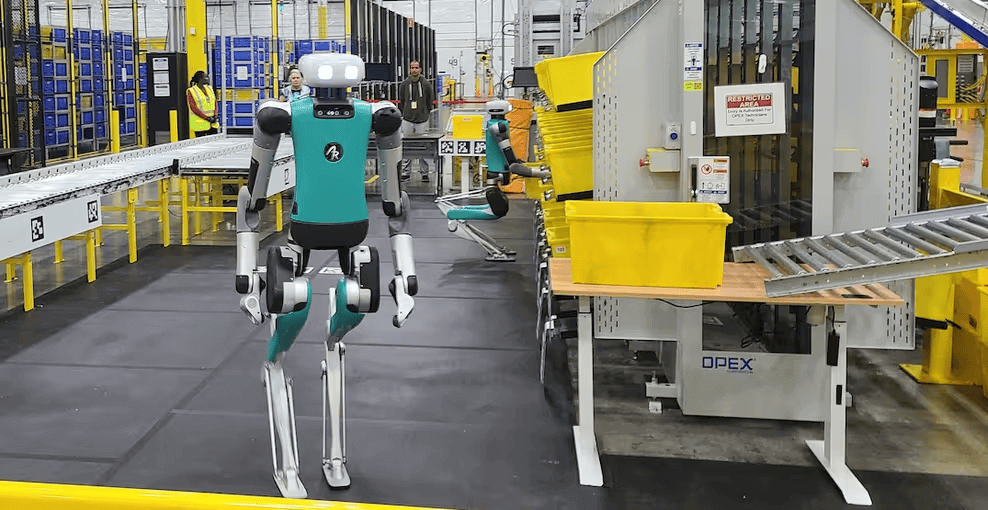

The corporate world is witnessing an unprecedented shift as artificial intelligence transforms from experimental tech to a workforce replacement strategy. Amazon (AMZN) plans to automate over 600,000 US jobs by 2033, targeting 75% of warehouse operations while doubling product sales. Meta (META) just axed 600 AI employees to "reduce bloat" while protecting its expensive new hires from Scale AI, cementing CEO Mark Zuckerberg's bet on premium talent over legacy workers.

Meanwhile, Tesla's (TSLA) robotics dreams hit reality as Q3 earnings dropped 31% year-over-year, though Elon Musk doubled down on unsupervised robotaxis by year-end and Optimus robot production starting in 2026. Musk also urged TSLA shareholders to approve his $1T pay package so he can maintain influence over the robot army that Tesla is creating. Wow, do we live in wild times.

OpenAI is training AI models with over 100 former investment bankers to replace junior analyst grunt work at firms like JPMorgan and Goldman Sachs through its secretive "Project Mercury."

The (supposed) cost savings of automation are massive: Amazon expects to save 30 cents per shipped item through warehouse automation. Of course, that sounds great in theory, but AI cost savings are largely unproven at this point. We wouldn’t be surprised to see a lot of angry unemployed people and labor activism coming up soon.

⚡️ The Tech Ticker

Hundreds of Adobe Magento stores were compromised after a critical security flaw was exploited.

Microsoft demanded 30% profit margins from its struggling Xbox division as the company faces slowing console sales and rising costs.

PC gamers are reporting that Windows 11’s Gaming Copilot feature is hurting performance, with some claiming the AI assistant captures gameplay data.

Google claimed a 13,000‑times speed advantage over supercomputers with its new Willow quantum chip.

Instagram introduced six new home‑screen icons exclusively for teen users, offering new designs restricted to Teen Accounts.

🔋 Apollo Drops an Energy Truth Nuke

Big Tech's AI ambitions are slamming into an uncomfortable truth: there simply isn’t enough power to fuel the revolution. Apollo Global's sustainability chief delivered a stark warning that the gap between AI energy demands and global grid capacity "will not be closed in our lifetime." We're talking about fundamentally reimagining how we generate and distribute electricity at scale.

The numbers are staggering. US electricity demand is projected to grow at 5x the previously predicted rate, with AI data centers potentially requiring 30x more power by 2035. Meta recently announced a $27 billion deal with Blue Owl Capital to fund and develop its Louisiana data center covering "a significant part of Manhattan's footprint."

We’re watching utilities, grid technology, and data center REITs. As AI workloads surge, power demand is expected to multiply several times before we close out the decade. The real money may lie in the substations, transformers, and land beneath the servers.

🤖 All Eyes on AI

General Motors unveiled new “eyes‑off” self‑driving technology, promising future models will allow users to totally disconnect while en route.

Snapchat made its Imagine Lens available for free to all US users, letting people create custom AI images from prompts like “turn me into an alien”.

Amazon introduced AI‑powered augmented reality glasses for delivery drivers, designed to project routes, scan packages, and capture proof of delivery.

OpenAI announced a data residency option for enterprise and public sector clients, allowing organizations like the UK’s Ministry of Justice to store data locally.

😆 Meme of the Week

🎙️ Shadow Dockets and the Humanoids at Home

This episode of The Best One Yet runs through a celebrity-led activist takeover at Six Flags, OpenAI’s new Atlas browser, and the NHL’s landmark partnership with predictions markets that could legitimize an emerging industry.

📻 Tune in to:

Hear why Travis Kelce and a hedge fund bought a 9% stake in Six Flags, and what they’re demanding.

Learn how OpenAI’s Atlas browser removes the friction between AI and the web, and why it might replace Chrome for some.

Get the lowdown on the NHL’s multi-year licensing deal with prediction-market firms, and why this deal is “arm candy” for the predictions industry.

🎧 Listen on:

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.