Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

😎 Most investors miss this data.

Want an edge? Start where others don’t look.

Most investors stop at earnings, revenue, and charts.

AltIndex digs deeper—into job listings, app downloads, web traffic, and social sentiment—to surface overlooked opportunities.

That’s how it correctly called:

Duolingo → up 96% in 14 months

Google → up 40% in 8 months

Manhattan Associates → up 31% in 11 months

It’s fast, easy to use, and built for how markets move today.

You’ll get 100+ daily buy/sell signals—powered by an AI model that filters noise and finds patterns with hedge-fund-level insights.

AltIndex is now part of Stocks & Income.

Sign up today and start trading with better data.

This week:

🌐 Court Ruling Keeps Tariffs Intact

🚗 NYC Road Tolls Raise Big Money

💊 Leading Pharma Firms Challenge Import Charges

🇨🇳 China and US Enter Higher Trade Friction

🏛 Political Portfolio Spotlight

Check back Wednesday for our weekly stock market roundup—and Friday for our tech industry edition.

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates at FinanceWrapped.com.

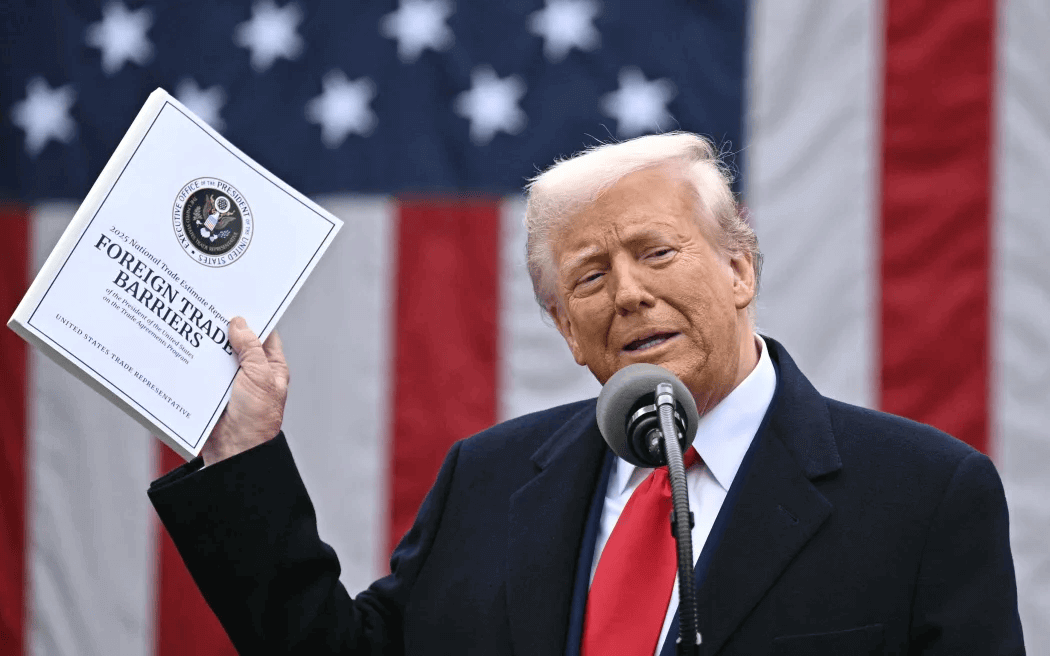

🌐 Global Tariffs Stop & Start; Steel Tariff Doubled

A federal appeals court temporarily reinstated President Trump's sweeping tariffs after a lower court ruled them unconstitutional.

Soon after, Trump posted on Truth Social that he plans to double the 25% tariff on steel and aluminum to 50%. This follows his support for Nippon Steel’s acquisition of U.S. Steel—which, he emphasized, will remain an American company and avoid tariffs. The EU has warned it’s ready to retaliate; read more below.

🚗 NYC Traffic Fees Generate $216 Million

Manhattan's new $9 peak-hour entry fee has generated $216 million in four months while cutting central business district traffic by 11%.

Public support climbed from 29% to 39% as the Metropolitan Transportation Authority tracks toward $500M annual revenue after expenses. The program survived a federal court challenge, clearing the way for $15 billion in planned transit bonds. This successful urban pricing model, mirroring systems in London and Singapore, opens fresh opportunities in municipal infrastructure investment.

💊 Pharma Giants Unite Against Import Tariffs

Major pharmaceutical companies warn that proposed medicine import tariffs threaten critical supply chains and risk triggering drug shortages.

Eli Lilly reversed its initial support, stating tariffs "will cause more harm than good" as new facilities require billions and 5-10 years to build. The generics sector, supplying 90% of US prescriptions through production in China and India, faces particular vulnerability. Many major companies shared comments and thoughts publicly—including a total flip-flop by Eli Lilly (click below to read).

🇨🇳 Broken Promises Bring New China Trade Escalation

President Trump declared China "totally violated" its recent trade agreement as Treasury Secretary Scott Bessent acknowledged stalled negotiations.

As is now customary, China shot right back with threats to “take resolute and forceful measures to safeguard its legitimate rights and interests” if the U.S. continues to “insists on its own way.” Renewed threats of expanded tariffs and stalled trade talks have deepened market jitters, while legal battles over the legitimacy of Trump’s policies continue.

Political Portfolio Spotlight

Elected officials have had a tremendous amount of success in the market recently.

We want to keep you updated on what they’re trading and when—so you can leverage that intel as you plan out your own portfolio.

Analysis provided by quiverquant.com.

Remember to always DYOR.

Sen. John W. Hickenlooper

(D-CO)

💲 Top Trades This Week:

[BUY] Liberty Media Formula N-V (FWONK)

[BUY] Liberty Broadband Corp. (LBRDK)

🔍 Analysis:

Hickenlooper’s activity this week centered on media and telecom. He opened or expanded stakes in both Liberty Media Formula and Liberty Broadband, signaling confidence in content distribution and broadband infrastructure. He appears to be betting on steady cash flows tied to digital media and connectivity rather than broader market themes.

Sen. John W. Hickenlooper

(D-CO)

📚️ Recommended Reading

Here’s a list of newsletters that our readers enjoy, covering topics like:

📈 Investing

💰️ Wealth building

🎥 Entertainment

👨💻 Coding

✅ And more

Check them out here.

Disclosures

There are affiliate links above; we'll get a couple of bucks if you take action after you click.

Nothing above is financial advice