Hello there.

Happy Friday! This week, Big Tech was kind enough to remind us that there’s never been a problem that more money couldn’t solve.

This week:

💳 Just $1 Trillion More, Trust Us

⚡️ Should Siri Just Take a Backseat at This Point?

🧠 Zuck’s Big-Brained Long-Game

🤖 …at the Same Time, He’s Desperately Trying to be Relatable

🎙️ The Nvidia of Glass & the Bling Wars

They’ve also assured us that there’s no reason to fact-check that. Cool guys, really.

In partnership with Trading Tips

2026 will be too late these 5 catalysts are already in motion

While everyone's making predictions about what might happen in 2026, we've identified 5 stocks with catalysts that are already locked and loaded.

These aren't hopes or projections. These are scheduled events, signed contracts, and approved projects that will play out over the next 12 months.

The difference between 100% gains and missing out completely? Positioning before 2026 arrives.

Our new report reveals 5 stocks with specific 2026 catalysts that could double your money:

- The industrial company that pivoted to AI with a $1.5 billion contract starting production in 2026

- A biotech with an FDA decision date in 2026 that could trigger a $60 million payment

- The sports betting leader whose exclusive ESPN partnership launches fully in 2026

- A cloud provider set to reveal a $60 billion backlog that could ignite its next growth phase

- The gold project that broke ground October 2025 for 2026 production ramp-up

Each catalyst has a date. Each date has a price target. Analysts project 70% to 125% upside across these five picks.

Click here to get your free copy of this report

(By clicking this link you agree to receive emails from us and our affiliates. You can opt out at any time. - Privacy Policy)

2026's biggest winners are being decided right now. Don't wait until January to start looking.

Please support our partners!

💳 Big Tech’s $1 Trillion IOU

Wall Street keeps waiting for the AI IPO parade. SpaceX! OpenAI! Anthropic! Cue the confetti cannons.

Instead, what we’re getting is a vibes-based bond market.

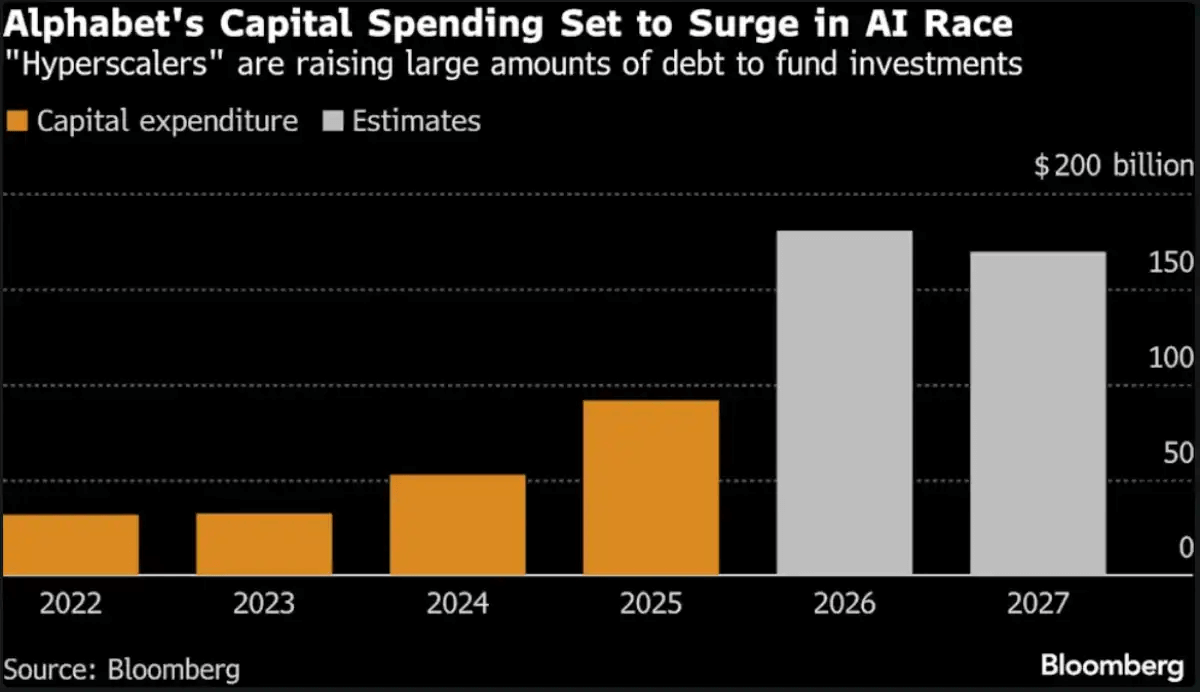

Tech and AI-related borrowing could approach $1 trillion in 2026(!), as hyperscalers scramble to finance their compute addiction. In fact, UBS estimates issuance could hit $990 billion this year as companies plug a massive financing gap in the AI buildout.

Alphabet alone just raised tens of billions in bonds. Meta and Amazon are back in the market. Even century bonds are making a cameo. Yes, 100-year debt. Because nothing says “we’re confident in AI” like locking in interest payments until 2126.

These are wildly profitable companies. But AI infrastructure is so expensive that even they don’t want to foot the bill solo. Data centers, GPUs, power contracts, talent wars…this isn’t a part-time kinda thing. It’s all or nothing (or all and nothing, time will tell).

For investors, the signal’s still choppy. On one hand, tight spreads suggest bond buyers see these giants as fortress balance sheets. On the other hand, sheer supply could push yields higher across the market, raising capital costs for everyone else.

The AI boom isn’t just an upfront equity story anymore. It’s quickly becoming a part of the credit cycle saga. And when debt markets get this big, well, you know the story.

🎤 What do you think?

Is it over for software or is this an overreaction to AI?

⚡️ The Tech Ticker

Apple's redesigned Siri is reportedly failing internal tests for being too slow, forcing the company to release only a partial version next month.

Americans now spend more on OnlyFans than on The New York Times and ChatGPT combined, suggesting the loneliness economy may be outpacing AI.

Discord will require age verification starting next month, putting all users into a "teen-appropriate experience" by default unless they verify their ID.

YouTube TV launched cheaper bundles, including a $65/month sports package, as Alphabet tries to compete with skinnier streaming options.

In partnership with AltIndex

Turning Social Data into Investing Insights

Chris Camillo famously turned $20,000 into $20 million by ignoring Wall Street spreadsheets and focusing on "Social Arbitrage." He proved that by observing shifts in culture and consumer behavior on the ground, you can often beat the "smart money" to the punch.

As Camillo puts it: "Sometimes investing is just a game of being early to the obvious."

But for the average investor, there’s a massive problem: How do you actually track "The Obvious" in real-time?

You can’t spend 24 hours a day reading every forum on the internet. But an algorithm can.

At AltIndex, we’ve taken the core philosophy of Social Arbitrage and applied it to the world's largest focus group: Reddit.

Our AI engine just processed 150,000+ raw Reddit comments, filtering out the "noise" and "bots" to find the top 10 stocks where real-world consumer sentiment is exploding right now.

Get the stocks today and see the signals for yourself.

🧠 Meta’s $2 Billion Vote of Confidence

Mark Zuckerberg spent years getting roasted for the metaverse pivot. Now he’s getting a $2 billion bandwagon.

Bill Ackman reportedly built a roughly $2 billion position in Meta, making it about 10% of Pershing Square’s portfolio. He went straight from dipping his toes to cannonballing into the AI pool.

Meta is going all-in on AI infrastructure, guiding for up to $135 billion in spending this year. It just began construction on a $10 billion data center in Indiana to beef up its AI capabilities. This is a dramatic pivot from burning cash in Reality Labs. That division has reportedly racked up $83 billion in losses since 2020. Investors hated that. AI glasses and superintelligence? Different vibe.

Ackman is betting that Meta’s ad machine plus AI monetization equals a second growth act. The bull case says Meta’s scale, distribution, and cash flow give it an edge in turning AI from a science project to a profit engine. The bear case says capex of this magnitude starts to look suspiciously like 2021 all over again.

The bigger takeaway for retail investors: smart money is rotating within tech, not away from it. The capital isn’t fleeing AI, just concentrating in companies with distribution, data, and actual earnings.

AI is getting more expensive. The debt is piling up. The bets are getting larger. And the investors writing billion-dollar checks seem convinced this isn’t peak hype.

We’re officially in the “show me the returns” phase.

🤖 All Eyes on AI

Facebook is rolling out AI-powered animated profile pictures along with a "Restyle" tool for Stories as Meta continues to court Gen Z.

Spotify revealed a major AI push as the streaming giant looks to integrate artificial intelligence across its platform.

Amazon is considering a marketplace where publishers can license content directly to AI companies for training data, following Microsoft's lead.

Blackstone boosted its stake in Anthropic to about $1 billion as the Claude maker continues attracting heavyweight institutional investors.

🤡 Meme of the Week

🎙️ The Nvidia of Glass & the Bling Wars

In this episode of The Best One Yet, we unpack the hidden physical bottleneck throttling the AI boom, why a 175-year-old materials company just became Meta’s newest MVP, and how two toy titans (and two luxury legends) are heading in very different directions.

📻 Tune in to:

Discover why Corning Glass quietly landed a $6 billion AI data center order, how it became the “Nvidia of Glass”.

Break down how Hasbro’s digital-first strategy is driving record profits while Mattel’s post-Barbie glow fades into a full-on “Barbie Bummer.”

Catch up on the “Bling Wars” between Cartier and Rolex, and how a decade-long strategy helped Cartier capture Gen Z and steal the luxury crown.

🎧 Listen on:

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake

Disclosures

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Finance Wrapped, AltIndex by Invested Inc. (AltIndex LLC), Stocks & Income, The Chain, Future Funders, and Dinner Table Discussions are all owned by Invested Inc.