Hello there.

Hundreds of investing and finance newsletters hit our (and maybe your) inboxes every week. This is the best of the best of policy from the past week. Every Wednesday, we’ll wrap up finance, and every Friday, we’ll take on tech.

This week, we’ve got…

🛢️ Oh No, a Naval Blockade! Anyway…

⚡️ The Policy Pulse

🚬 Marlboro Man Hurting on Russia Sales

₿ The Coin Toss

😆 Meme of the Week

🏛 Political Portfolio Spotlight: Rep. Thomas H. Kean, Jr. (R-NJ)

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates at FinanceWrapped.com.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with Avalara

Tired of sales tax headaches? Get clarity in minutes

Avalara AvaTax helps automate sales tax calculation and track economic nexus across more than 12,000 U.S. sales and use tax jurisdictions. Now, finance, tax, and operations teams can see how it works without scheduling a call.

This self-guided interactive tour shows how AvaTax connects to more than 1,400 signed partner integrations, applies more than 900,000 tax rules and 82,000 tax rates, and flags transactions by jurisdiction. You’ll see how to map products to the right codes, customize reports, and stay audit-ready.

There is no pressure, no pitch, and no slide deck. Just the solution in action, on your time.

Join the more than 43,000 customers already using Avalara for more accurate and scalable compliance.

Please support our partners!

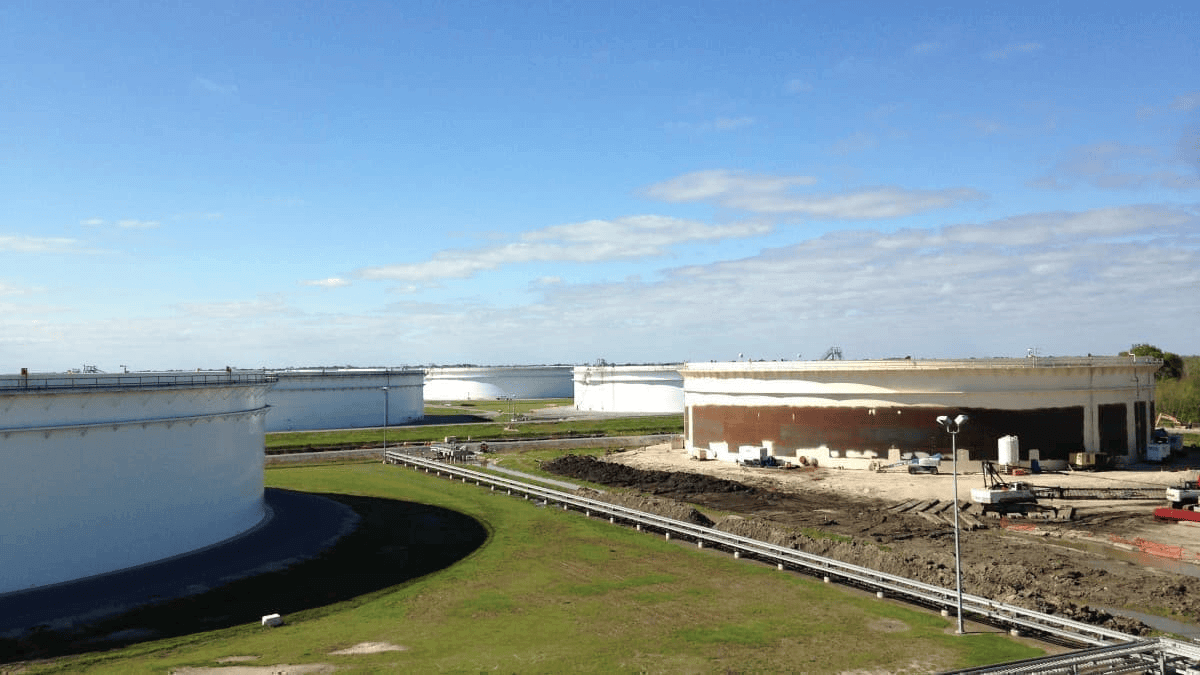

🛢️ Venezuela Drama Pushes Brent Back Above $60

Trump casually mentioned he won't rule out war with Venezuela, and oil traders collectively remembered that geopolitics is still a thing. Brent crude limped back above $60 per barrel after it hit four-year lows.

Here's the plot twist: the market barely flinched. Venezuela pumps less than 1% of the global oil supply, and the US is drowning in domestic crude. The real comedy is Trump's team asking Exxon and ConocoPhillips if they want back into Venezuela post-Maduro. Their response? "Not really, no." At $57 oil (WTI), even the world's largest reserves aren't worth the headache of rebuilding a country's oil infrastructure from scratch.

Energy players like Valero and Phillips 66 could see refining margins tighten if Venezuelan barrels actually disappear. But with the Permian Basin rig count at its lowest since 2021 and a global supply glut looming in 2026, this feels more like a temporary blip than a sustained rally. The XLE energy ETF might get a bounce, but don't mistake noise for signal 👆

⚡️ The Policy Pulse

Fed Chair Jerome Powell signaled fewer cuts ahead in 2026 as inflation remains sticky above the 2% target.

Elon Musk's 2018 Tesla pay package was restored by the Delaware Supreme Court, overturning a court ruling that had struck down the compensation deal.

Trump Media is merging with fusion power company TAE Technologies in a deal valued at more than $6 billion, expanding the Truth Social parent.

Federal Reserve Governor Christopher Waller reportedly had a strong interview for the Fed chair position with President Trump.

More drugmakers reached deals with the White House to lower prices, with 9 pharmaceutical companies, including BMS, GSK, and Merck, agreeing.

🕊️ These US Stocks Are Banking on Peace

Russia-Ukraine peace negotiations are heating up, and while European defense stocks are having an existential crisis, American investors should be eyeing the consumer brands that got absolutely wrecked by pulling out of Russia.

Philip Morris is the poster child here, with 8% of total sales coming from Russia and Ukraine before the war. That's nearly double any other S&P 500 stock's exposure. The company still pays a juicy 5% dividend yield, and analysts think a peace deal could boost EPS growth back toward normal levels. PepsiCo had 4.4% revenue exposure and has been quietly maintaining volume growth despite the hit. McDonald's operated over 600 Russian locations, representing 4.2% of revenue, before shutting them down.

Defense contractors like Lockheed Martin, Northrop Grumman, and Raytheon sold off on peace optimism, but NATO spending commitments run through 2035. Countries will spend the next decade restocking weapons sent to Ukraine. The "peace dividend" everyone's pricing in might actually be a "restocking boom" nobody's ready for.

₿ The Coin Toss

Citigroup set a base-case target of $143,000 for Bitcoin in 12 months, citing increased adoption driven by potential US digital asset legislation.

Coinbase sued Connecticut, Illinois, and Michigan over prediction market regulations, claiming that event contracts fall under federal CFTC jurisdiction.

The US Senate is facing a closing window to pass landmark cryptocurrency legislation, as bipartisan negotiations stretch into an election year.

The Federal Reserve sought feedback on establishing crypto-driven “master accounts” for a select few firms.

Bitcoin continued to fight a $90,000 price ceiling through the end of the week, after a recent downturn in investor sentiment across the industry.

😆 Meme of the Week

🎙 Tell Us Your Thoughts

⭐️ What did you think of today's edition?

🏛 Political Portfolio Spotlight

Elected officials have had a tremendous amount of success in the market recently.

We want to keep you updated on what they’re trading and when so you can leverage that intel as you plan out your own portfolio.

Data provided by AltIndex.

Remember to always DYOR.

Rep. Thomas H. Kean, Jr. (R-NJ)

💲 Top Trades This Week:

[BUY] Texas Instruments (TXN)

🔍 Analysis:

Kean reported a small but telling set of trades centered on semiconductors and healthcare. His lone buy (Texas Instruments) adds exposure to analog chips, a segment tied to industrial demand, autos, and long product cycles rather than headline-driven AI volatility.

On the sell side, he trimmed two healthcare heavyweights. The sales of Johnson & Johnson and Stryker suggest a partial rotation out of defensive medical names, potentially locking in gains or reallocating capital toward cyclicals with clearer upside leverage. We aren’t sure if he made profits or not on his JNJ and SYK sales; he likely bought those stocks before he took office in 2023, so we don’t know what price he got in on those stocks at.

Overall, the activity points to a modest shift away from healthcare stability and toward industrial-tech exposure tied to broader economic activity.

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake with Invested Inc.

Disclosures:

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable. Past performance does not guarantee future results.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.