Hello there.

Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best of finance from last week. Friday, we’ll cover tech, and next Monday, we’ll tackle policy.

This week, we’ve got…

💊 Big Pharma's Trillion-Dollar Tussle

⚡️ Finance Quick Fix

🎢 Dalio Says Don't Sell (Yet)

🎭 Winners & Losers

😆 Meme of the Week

📈 Top Stock Ideas

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates at FinanceWrapped.com.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with Long Angle

How High-Net-Worth Families Invest Beyond the Balance Sheet

Every year, Long Angle surveys its private member community — entrepreneurs, executives, and investors with portfolios from $5M to $100M — to understand how they allocate their time, money, and trust.

The 2025 High-Net-Worth Professional Services Report reveals what today’s wealthy families value most, what disappoints them, and where satisfaction truly comes from.

From wealth management to wellness, from private schools to personal trainers — this study uncovers how the top 1% make choices that reflect their real priorities. You’ll see which services bring the greatest satisfaction, which feel merely transactional, and how spending patterns reveal what matters most to affluent households.

Benchmark your household’s service spending against peers with $5–25M portfolios.

Learn why emotional well-being often outranks financial optimization.

See which services families are most likely to change — and which they’ll never give up.

Understand generational differences shaping how the wealthy live, work, and parent.

See how your spending, satisfaction, and priorities compare to your peers. Download the report here.

Please support our partners!

💊 Lilly’s Left Novo Seeing Stars

Eli Lilly just became healthcare's first trillion-dollar company, and honestly, it's less of a milestone and more of a victory lap. The Indianapolis drugmaker's weight-loss injection Zepbound and diabetes treatment Mounjaro are printing money ($10.11 billion combined in Q3 alone), while chief rival Novo Nordisk is having what can only be described as a very bad year.

Novo's stock cratered 45% in 2025, hit a four-year low this week, and just watched its golden goose Alzheimer's drug spectacularly fail in trials. The Danish giant also fired its CEO, replaced half its board, and is now cutting 10% of its workforce. Meanwhile, Lilly's stock is up 37% and the company is building a $6.5 billion Texas facility to crank out an oral version of its blockbuster drugs. The weight-loss market could hit $150 billion by the early 2030s, and right now there's a clear frontrunner.

If you’ve been on the outside of healthcare, now’s a good time to take the inside lane: Lilly has momentum, manufacturing capacity, and a product pipeline that's actually working. Novo is scrambling. The full breakdown is worth your time.

⚡️ Finance Quick Fix

Billionaires bought beaten-down stocks last quarter as markets rallied to record highs, with David Tepper's firm increasing its Whirlpool stake by 2,000%.

Larry Page became the world's second-richest person, bumping Larry Ellison, as Alphabet shares rallied after the Buffett buy-in.

Consumer sentiment fell more than expected in November, with the University of Michigan's index dropping 29% year-over-year.

US retail sales rose 0.2% in September, moderating after strong summer gains as resilient consumers pulled back due to high prices on staple goods.

Gold slipped as traders assessed geopolitics and the Fed rate outlook, with bullion dipping down to $4,129.04 an ounce.

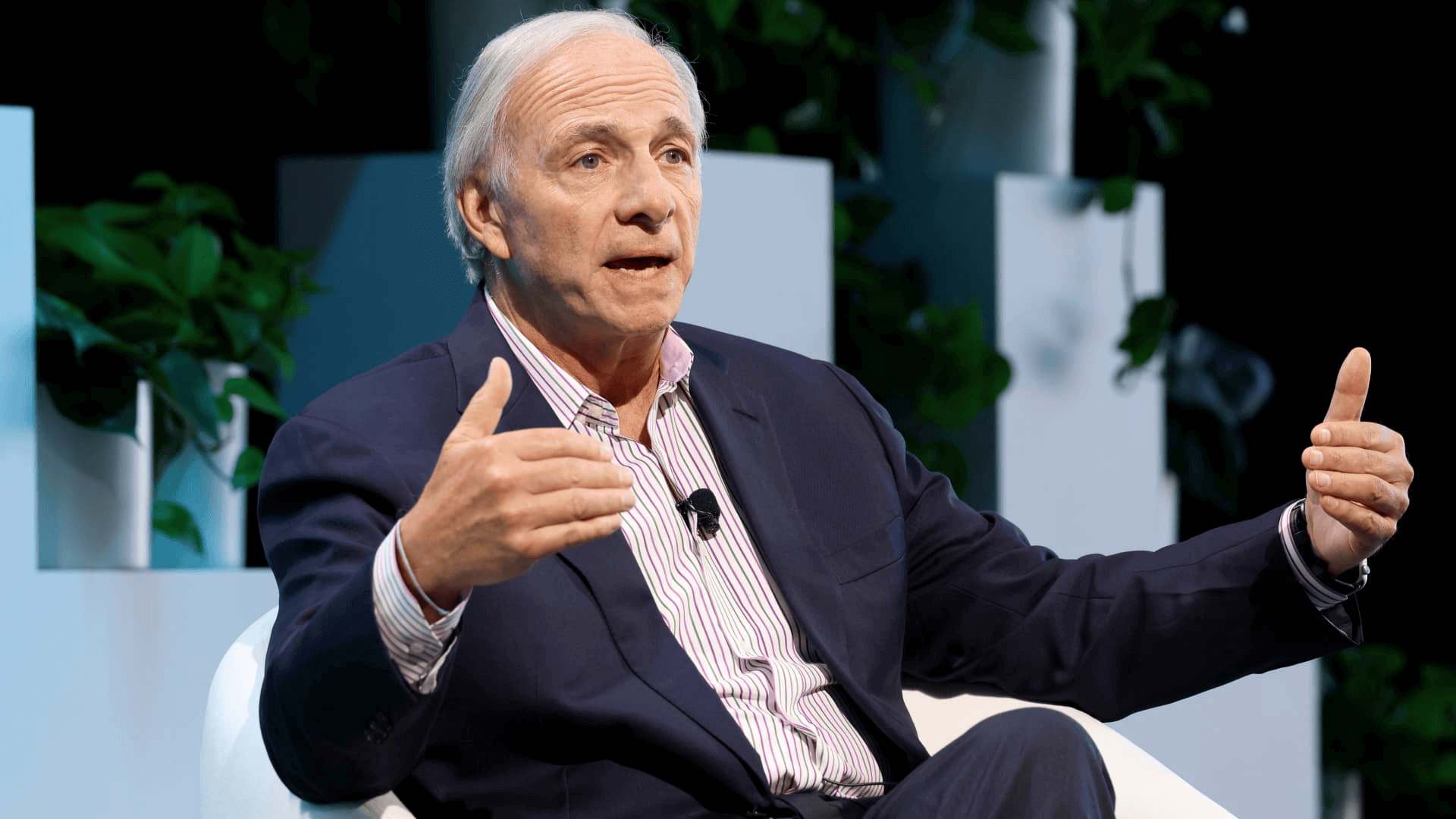

🎢 The Big Bubble Debate

Ray Dalio confirmed we're in a bubble, but told investors not to panic-sell. In other words, “Don’t sell, we need you for exit liquidity!” But actually, here’s his real logic: bubbles need a pin to pop them, and tighter monetary policy isn't it. Wealth taxes, maybe. Either way, he sees portfolio diversification as a key to surviving the bubble (buying gold in particular).

On the other hand, Nvidia CEO Jensen Huang brushed off bubble talk, saying, "We see something very different." And yeah, who wouldn’t with the year they’ve had? (Although GOOGL is seriously giving NVDA a run for its money, threatening to take Meta’s chip orders.) Still, Dalio's less convinced, warning that when valuations hit this territory, the next decade's returns tend to suck.

Meanwhile, Bitcoin ETFs are bleeding, on track for their worst month since launching nearly two years ago. Investors pulled $3.5 billion in November, nearly matching February's record. Permabulls are still calling for Bitcoin to hit $200,000 by January's end, and $3 million by 2030. That’s the party line, at least. The crypto faithful are holding, but then again, there’s hardly a market with more of a sunk-cost fallacy problem.

🎭 Winners & Losers

A lot can happen in a week!

Let’s take a quick look at who struck gold and who struck out since our last issue:

🏆 Winners

Alphabet (GOOGL): +12.80%

Broadcom (AVGO): +9.82%

Meta Platforms, Inc. (META): +4.45%

Apple, Inc. (AAPL): +4.12%

😞 Losers

🫡 Meme of the Day

📈 Stock ideas

Analysis provided by altindex.com.

Remember to always DYOR.

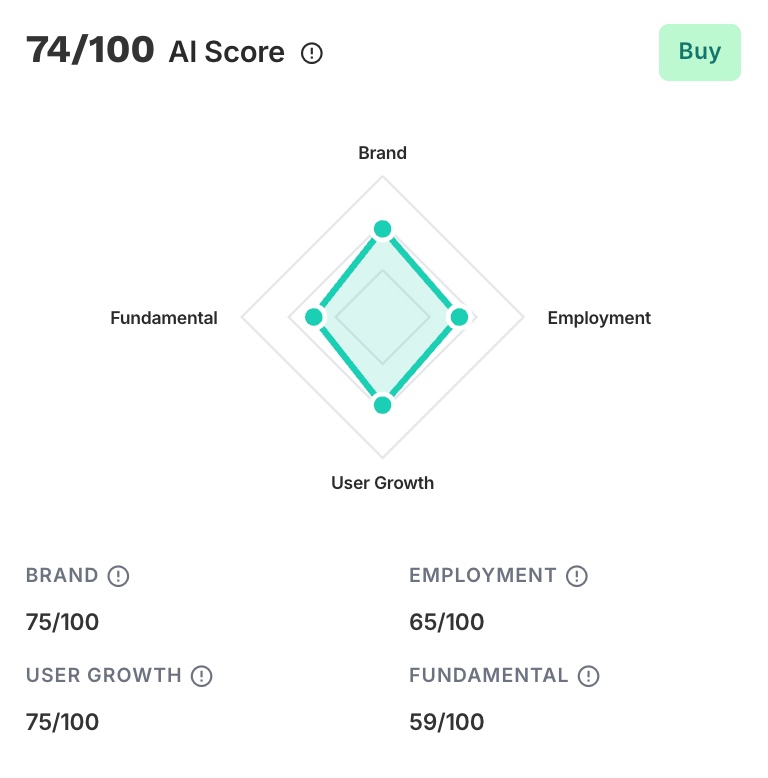

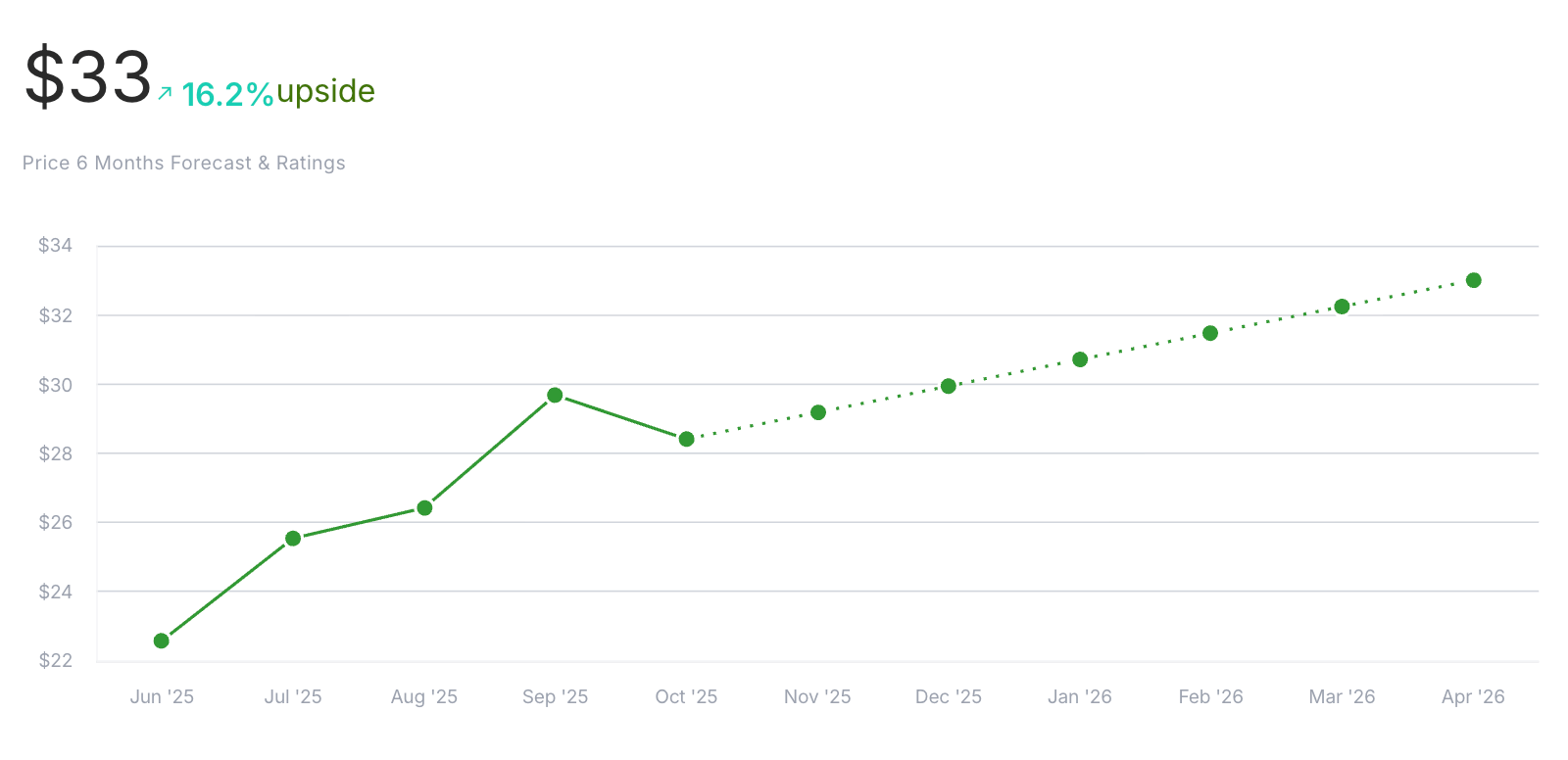

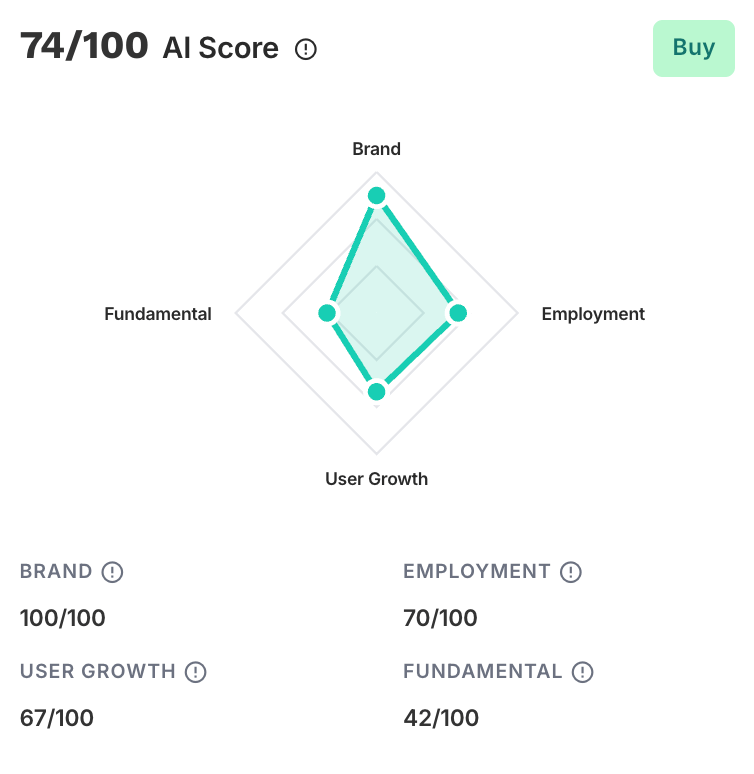

SoFi $SOFI

SoFi Technologies Inc. (NASDAQ: SOFI) is a fintech company offering a suite of financial products including loans, investing, and banking services through its digital platform. Founded in 2011, SoFi's mission is to help its members achieve financial independence by providing comprehensive financial services in a user-friendly, digital-first approach. The company has grown significantly, leveraging its technology to attract over 23 million visitors to its web platform while maintaining a strong presence across various social media channels like Instagram and Twitter.

The signals:

Revenue: $1.27B. That’s a 12.27% increase since last quarter and a 28.58% increase over the past year

Net income: $139M. Up 43.31% quarter over quarter and up 129.47% year over year

Negative short-term but positive long-term price momentum

RSI is neutral at 47.6.

P/E ratio is high at 48.93. Could reflect overvalution

Alternative data over the past few months:

25% increase in app downloads

30% decrease in job postings

19% increase in web traffic

4% increase in Twitter followers

Current price: $28.53

Target price: $33

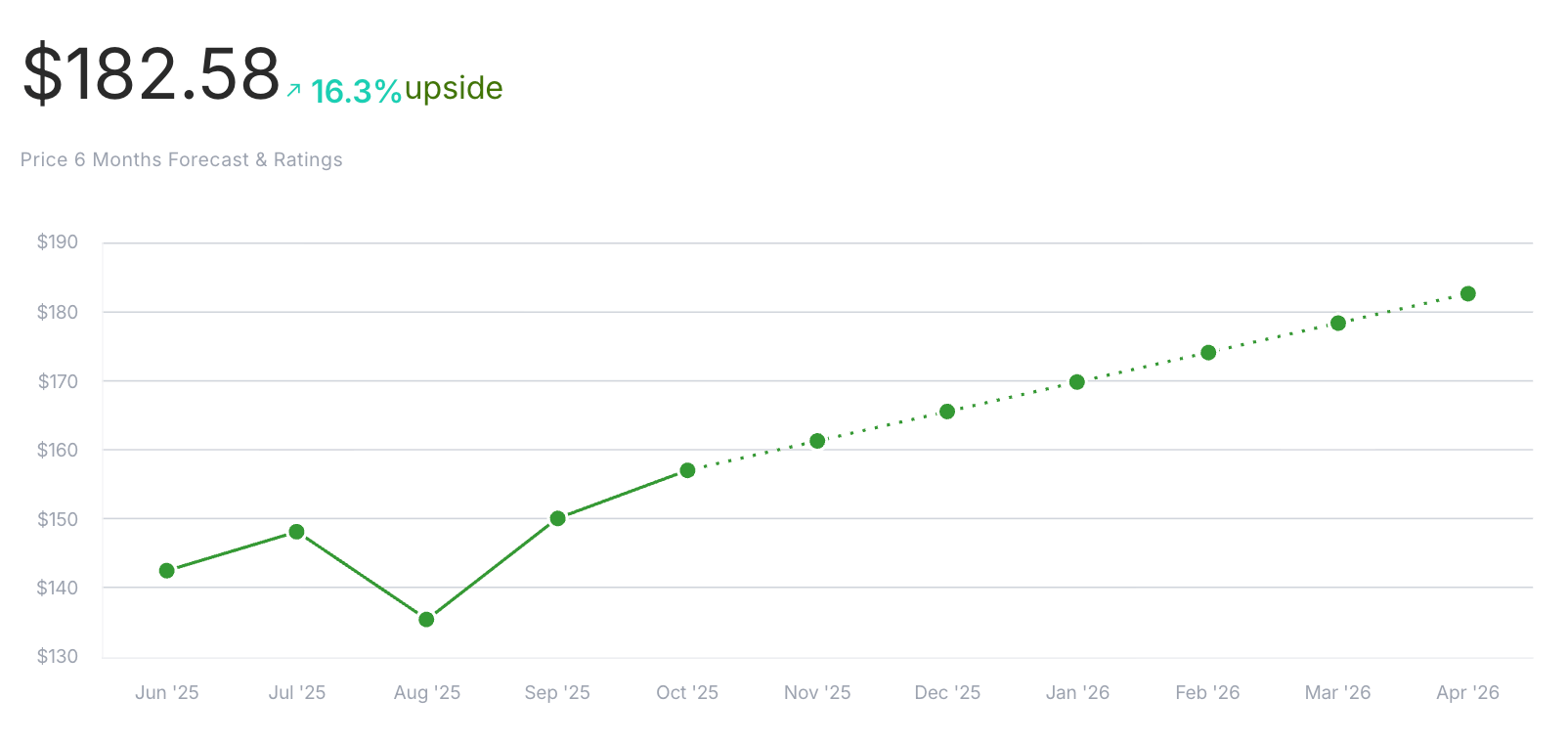

Nucor $NUE

Nucor Corporation is a leading American producer of steel and related products headquartered in Charlotte, North Carolina. As the largest steel producer in the United States, Nucor has a diversified portfolio that includes steel mills, steel products, and raw materials. The company is well-known for its innovative approach to steel manufacturing and its commitment to sustainability, which is reflected in its efficient recycling processes. Nucor aims to be a leader in environmental responsibility while also focusing on growth and profitability through strategic investments and acquisitions.

The signals:

Revenue: $8.52B. Up 0.77% since last quarter and up 14.47% since last year

Net income: $607M. Increased 0.66% over the past quarter and up 142.89% year over year.

Positive short-term and long-term momentum

RSI is low at 15.5; potentially oversold

P/E ratio is 21.61, which is within a normal range for the industry

Alternative data over the past few months:

7% increase in job postings

87% positive employee sentiment

13% increase in web traffic

24% increase in Instagram followers

Current price: $157.48

Target price: $182.58

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake of Invested Inc.

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.