Hello there.

Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best of finance from last week. Friday, we’ll cover tech, and next Monday, we’ll tackle policy.

This week, we’ve got…

🏋️ NVDA’s Carrying the NYSE

⚡️ Finance Quick Fix

😯 Buffett Chooses GOOGL?

🎭 Winners & Losers

😆 Meme of the Week

📈 Top Stock Ideas

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates at FinanceWrapped.com.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with Coactive

Make money cleaning up the planet.

TerraCycle has spent two decades solving one of the biggest problems on Earth: trash.

By partnering with hundreds of global brands like Coca-Cola, Unilever, and Whole Foods, they’ve created profitable recycling solutions for “unrecyclable” materials.

With more than 10 years of profitability and steady dividend payouts to investors, TerraCycle is proving that doing good can pay off.

Now, you can invest directly in their mission and get 15% bonus stock.

This is a paid advertisement for TerraCycle’s Regulation CF offering. Please read the offering circular at https://invest.terracycle.com/

Please support our partners!

🏋️ Everything Is On Nvidia’s Shoulders (Again)

It’s been a rough week for markets, let me tell you. Over the past 7 days, the S&P 500 is down 2.7%, Bitcoin has fallen 4.8%, and gold is down 2.9%. There’s a litany of reasons why everything’s red, and Christmas is not one of them:

Papa Powell has not guaranteed rate cuts in December

Michael Burry shorted the AI market, then closed his hedge fund

SoftBank and Peter Thiel sold their NVDA positions

Layoffs are happening across industries

People are asking whether AI growth is still justified

Things aren’t looking good, but there are two massive pieces of data that markets will receive today that could shift things one way or another: Nvidia’s Q3 earnings report and the FOMC’s October meeting minutes. A lot of investors are looking to see NVDA beat earnings and for the Fed to hint at its upcoming rate decision in December.

In the midst of all that noise, several stocks have been sending consistent, strong signals. AltIndex’s AI has chosen 10 stocks it thinks have more potential than any others right now.

The #2 stock is Alamos Gold (AGI). Want to see the rest?

⚡️ Finance Quick Fix

Walmart CEO Doug McMillon announced he will retire after more than a decade, with US division chief John Furner set to take over on January 31.

Packaging company Sealed Air is in talks to go private, with private equity firms exploring a potential buyout of the maker of Bubble Wrap and Cryovac.

Topgolf is in talks to be sold to private equity firm Leonard Green, with the potential deal valued at several billion through parent company Callaway Golf.

Bain Capital struck a deal to acquire Concert Golf Partners from Clearlake Capital, including all 39 locations across the US.

😯 Out of the Wreckage… Google Rises?

While markets have been in the red all week, there’s one Magnificent 7 member that’s sucked less than all the rest: Google. And that’s because Warren Buffett bought 1.8 million shares of it. Which is crazy, because Buffett’s Berkshire Hathaway has typically stayed away from tech. And Buffett’s a value investor, so the implication here is that he and his investors think Google is undervalued…

Interesting.

So everybody’s worried about the AI bubble popping, prices are going down, and one of the greatest investors of all time just bought almost $5B worth of GOOGL shares, sending the price up 3.7% over the past week.

Ok, I’m intrigued. Buffett’s throwing down the gauntlet. Alexa, play Danger Zone.

🎭 Winners & Losers

A lot can happen in a week!

Let’s take a quick look at who struck gold and who struck out since our last issue:

🏆 Winners

Eli Lilly and Company (LLY): +7.25%

Netflix, Inc. (NFLX): +2.26%

Berkshire Hathaway Inc. (BRK.A): +1.81%

😞 Losers

🫡 Meme of the Day

📈 Stock ideas

Analysis provided by altindex.com.

Remember to always DYOR.

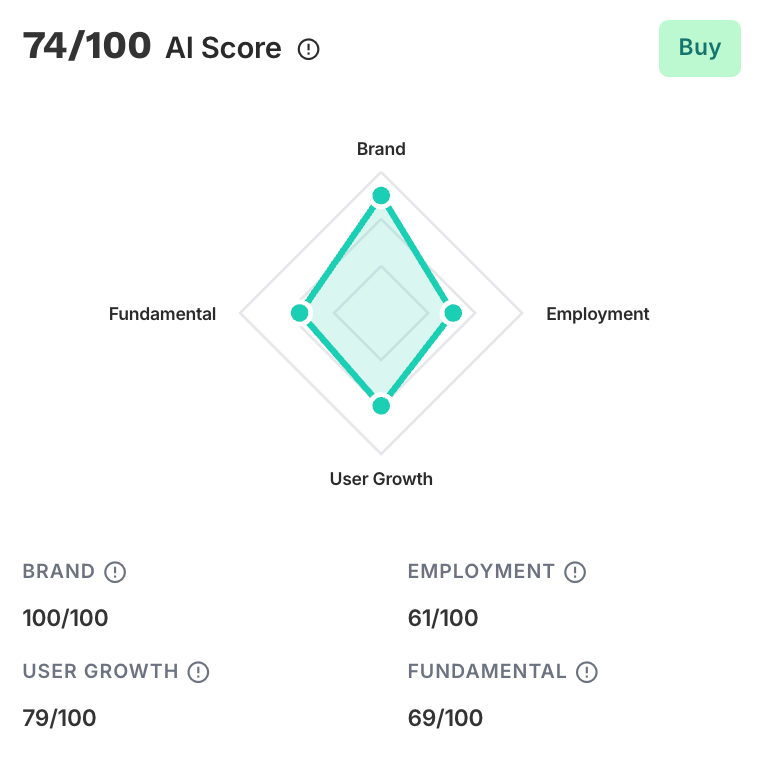

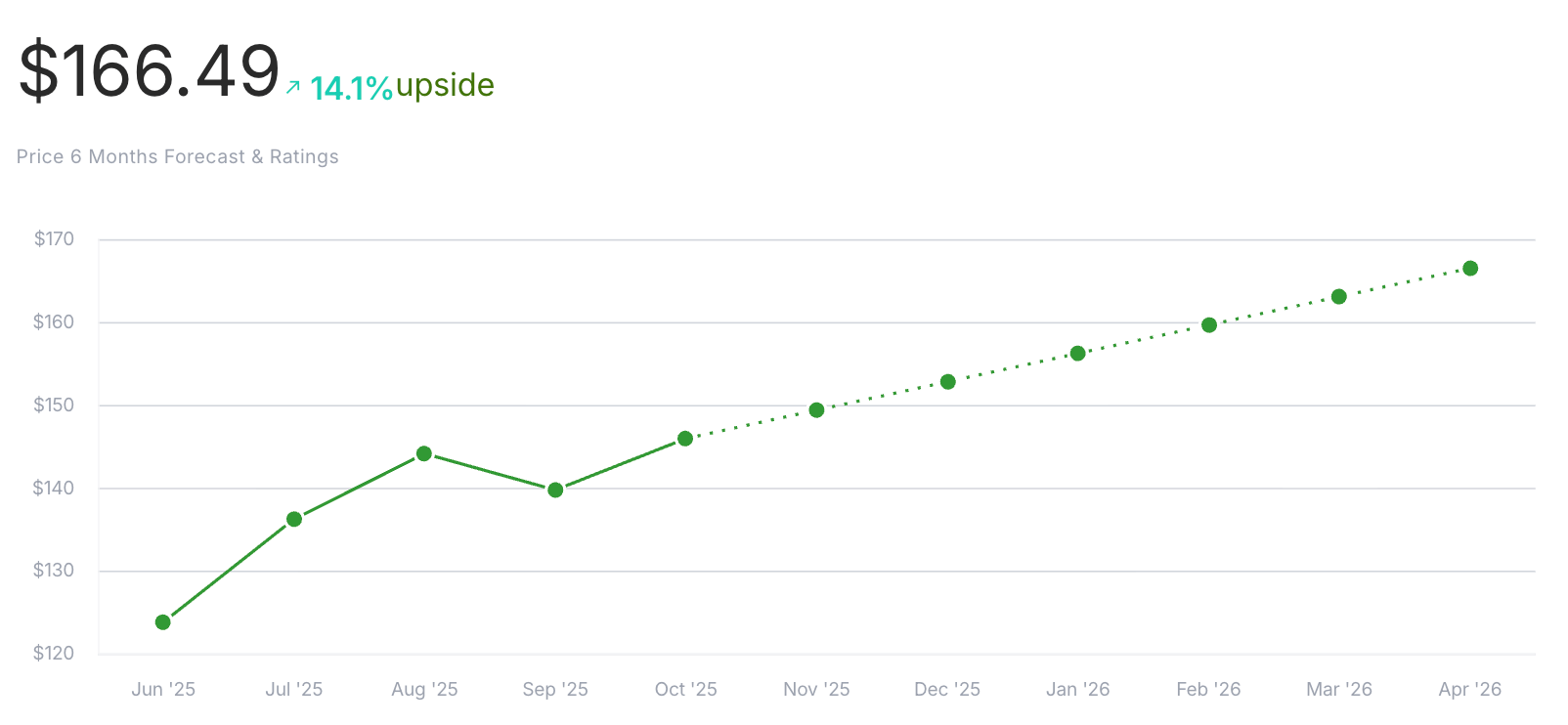

TJX Companies $TJX

The TJX Companies, Inc. is a leading off-price retailer of apparel and home fashion products. It operates T.J. Maxx and Marshalls (Marmaxx), HomeGoods, Sierra, and Homesense, as well as tjmaxx.com, marshalls.com, and sierra.com, in the U.S.; Winners, HomeSense, and Marshalls (TJX Canada) in Canada; and T.K. Maxx in the U.K., Ireland, Germany, Poland, Austria, the Netherlands, and Australia, as well as Homesense in the U.K. and Ireland, and tkmaxx.com in the U.K. (TJX International).

The signals:

Revenue: $14.4B. That’s a 9.84% increase since last quarter and a 6.93% increase over the past year

Net income: $1.24B. Up 19.98% quarter over quarter and up 13.10% year over year

Positive short-term and long-term price momentum

RSI is high at 78.9, meaning the stock might be overbought

P/E ratio is high at 33.24. Could reflect overvalution

Alternative data over the past few months:

46% increase in job postings

311% increase in Facebook engagement

6% increase in Instagram followers

Current price: $145.94

Target price: $166.49

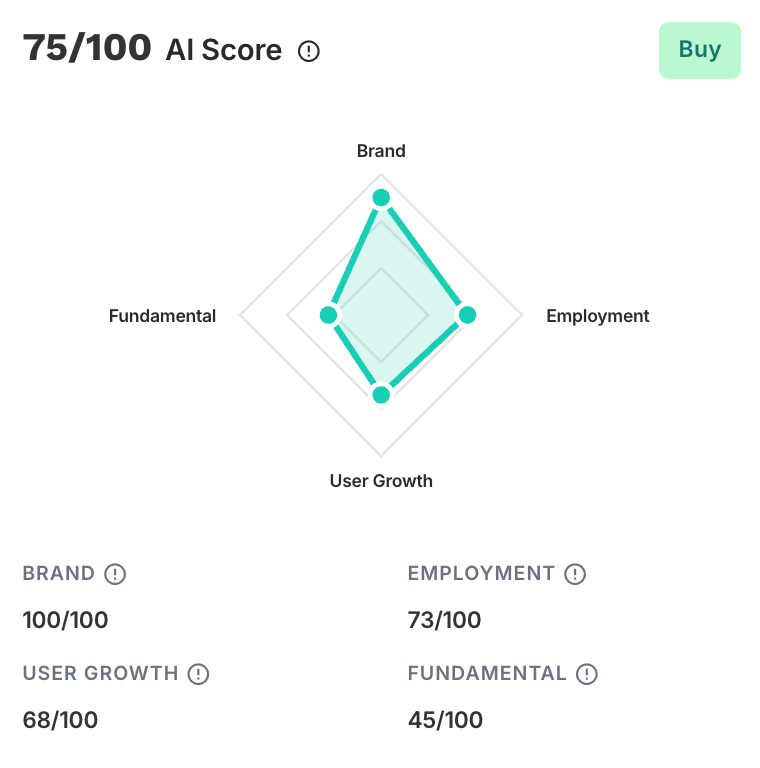

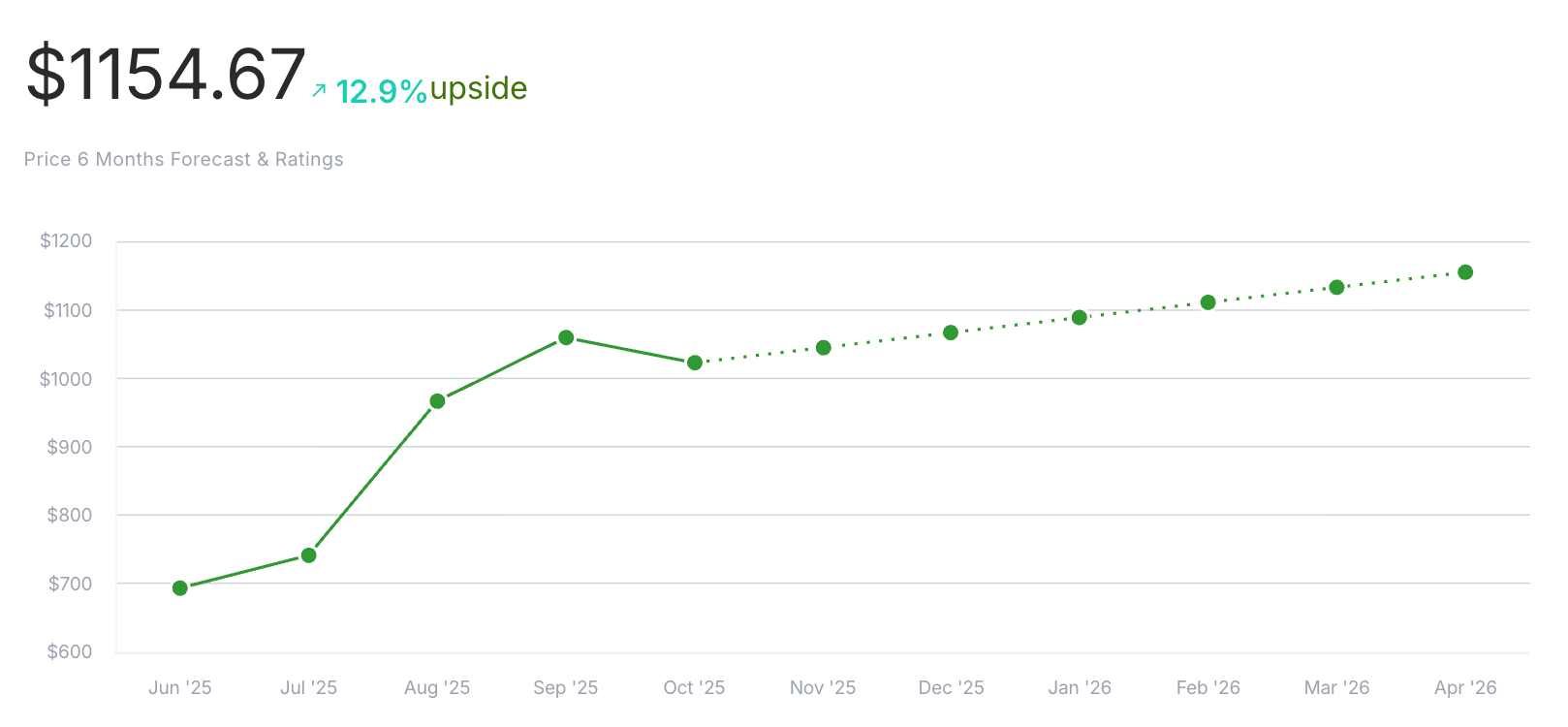

ASML $ASML

ASML Holding NV (ASML) is a Dutch multinational company engaged in the development, production, and distribution of photolithography systems used in the semiconductor industry. ASML's technology is integral to the manufacturing of integrated circuits (IC), which power a multitude of electronic devices. With a dominant position in the market and cutting-edge EUV lithography, ASML is a critical player in the semiconductor supply chain.

The signals:

Revenue: $7.52B. Down 2.28% since last quarter but up 0.65% since last year

Net income: $2.12B. Decreased 20.62% QoQ but up 2.31% YoY

Slightly negative short-term momentum but HUGE long-term momentum (shares are up over 50% the past year)

RSI is high at 84.4; potentially overbought

P/E ratio is 36.23, suggesting the stock might be overvalued

Alternative data over the past few months:

11% increase in job postings

9% increase in Twitter followers

24% increase in Facebook engagement

Current price: $1023.41

Target price: $1154.67

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake of Invested Inc.

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.