Hello there.

Trump cancelled Iran talks, gold blew past $4,600, Hollywood is suing itself, and Meta just hired Wall Street’s most powerful… phone book?

Another perfectly normal week to kick off 2026.

📺 All-Out War, Streaming Live

⚡️ Finance Quick Fix

🤝 A Senator, a Banker, and an Infrastructure Maker

😆 Meme of the Week

📈 AltIndex’s Top Stock Ideas for the Week

Let’s get started.

In partnership with Vintage Funds

There’s a reason mobile home parks are getting so much institutional love.

They remain one of the key affordable-housing sources nationally, have limited supply and high tenant retention (10-12Y). Investors can see tremendous upside with professionally-managed MHP portfolios such as Vintage Capital’s, which targets a 15-17% IRR and makes monthly distributions. Invest directly in individual deals or via a 10+ property fund. 1031s also available.

Please support our partners!

📺 Hollywood's Billion-Dollar Cage Match

Paramount Skydance just went full scorched-earth on Warner Bros. Discovery, filing a lawsuit in Delaware and launching a proxy fight after WBD's board rejected its hostile takeover bid for the eighth time. CEO David Ellison is demanding financial details about WBD's $83 billion deal with Netflix, specifically how the company valued its cable networks spinoff and why it keeps insisting Netflix's $27.72 per share is better than Paramount's $30 all-cash offer.

The whole mess started when WBD agreed to sell its streaming platform HBO Max and film studio Warner Bros. to Netflix, while spinning off its legacy cable channels into a separate company called Discovery Global. Paramount has made eight bids now, each time arguing the sale process was rigged, and each time getting told to kick rocks. WBD's response? "Paramount has yet to raise the price or address the numerous and obvious deficiencies of its offer." Translation: show us more money or stop wasting our time.

The kicker is that Paramount's backing includes a $40.4 billion personal guarantee from Larry Ellison (Oracle co-founder and fourth-richest person on Earth), but WBD isn't impressed. They're pointing to Paramount's junk credit rating, negative free cash flows, and the fact that the deal would saddle them with $87 billion in debt. Meanwhile, Netflix is already working with regulators to close its acquisition. Paramount is now nominating its own slate of directors for WBD's board and trying to force a shareholder vote on the cable network spinoff. Either this is the world's most expensive temper tantrum or Ellison sees something everyone else is missing—like maybe the opportunity to purchase CNN and fire some hosts.

⚡️ Finance Quick Fix

Crude oil prices rose 3% after Trump cancelled all meetings with Iranian officials and announced a 25% tariff on any country trading with Iran.

Gold hit a record above $4,600 per ounce, and silver reached an all-time high above $90 as investors piled into safe-haven assets after a week of uncertainty.

JPMorgan will boost costs to compete with Stripe, SoFi, and Schwab, with CEO Jamie Dimon asking investors to “trust me” on the expense increase.

Wall Street reboots leverage in $153 billion active stock trades as banks return to aggressive positioning after years of restraint.

Spotify's new co-CEOs are fighting to save the platform's subscribers from algorithm fatigue by testing features like Prompted Playlists and video content.

🤝 Meta Hires Wall Street's Best Rolodex

Meta just poached one of the most connected executives on Wall Street, naming Dina Powell McCormick as the company's new president and vice chairman. Powell McCormick spent decades at Goldman Sachs running their sovereign wealth fund business and building relationships with literally every major pool of capital on the planet. She also advised two US presidents, including Trump, who posted "great choice by Mark Z!!!" on Truth Social after the announcement.

The hire signals a major shift in Meta's strategy. After spending billions on AI talent and shelling out nearly $15 billion to Scale AI alone, the company may now be looking to tap outside capital and strike the kind of strategic partnerships that rivals like Nvidia, OpenAI, and xAI have been aggressively pursuing in the Middle East. Powell McCormick will focus on securing partnerships and overseeing Meta's $600 billion infrastructure buildout over the next decade, which sounds like code for "we need sovereign wealth fund money, and she knows everyone who controls it."

Wall Street loves the move. JPMorgan CEO Jamie Dimon called her "a better banker with more relationships than many big finance CEOs," while Blackstone's Stephen Schwarzman said she's "enormously successful wherever she goes." Powell McCormick immigrated from Egypt at age six without speaking English, rose to partner at Goldman, and played a key role in laying the groundwork for the Abraham Accords. Now she's tasked with making sure Meta doesn't fall behind in the AI arms race because it ran out of cash or friends. Smart hire or desperate move? Probably both.

🫡 Meme of the Day

📈 Stock ideas

Analysis provided by altindex.com.

Remember to always DYOR.

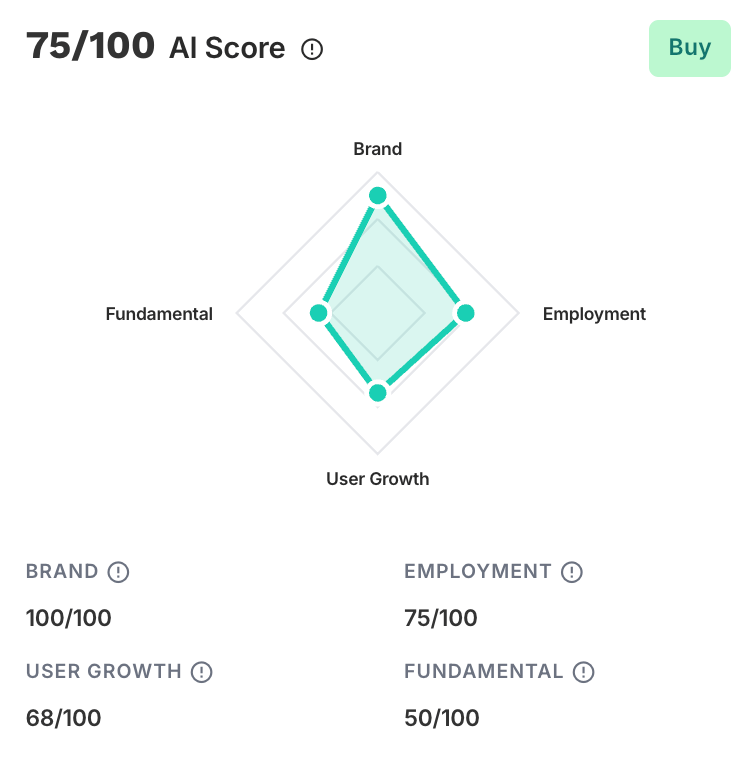

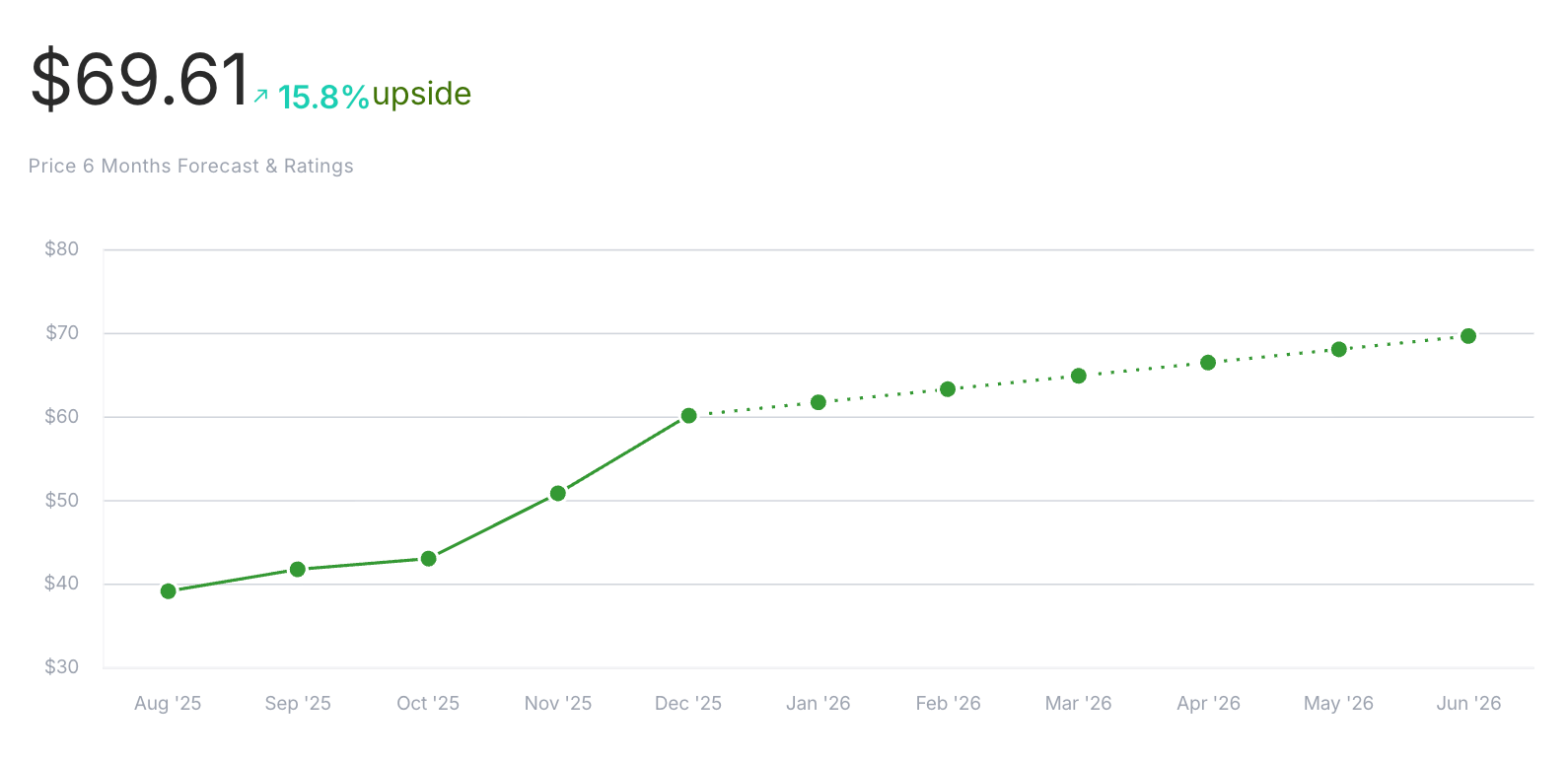

Freeport-McMoRan $FCX

Freeport-McMoRan Inc. (FCX) is a leading international mining company with significant assets in copper, gold, and molybdenum. Their extensive operational capabilities, strategic acquisitions, and efficient management practices establish them as a strong player in the mining sector. The company has consistently generated substantial revenues and maintained robust production volumes, making it a reliable name in the industry.

The financial data:

Revenue: $6.97B. That’s an 8.05% decrease since last quarter but a 4.37% increase over the past year

Net income: $674M. Down 12.69% quarter over quarter but up 29.62% year over year

Price momentum: The stock is up 26.83% the past month and up 51.86% the past year.

RSI: Oversold territory at 13.9 (What is RSI?)

P/E: High at 41.06; could be overvalued or just an indication of strong future growth expectations (What is P/E?)

Alternative data over the past few months:

807% increase in Facebook engagement

163% increase in X mentions

81% positive employee sentiment

13% increase in Instagram followers

4% increase in X followers

Current price: $59.87

Target price: $69.61

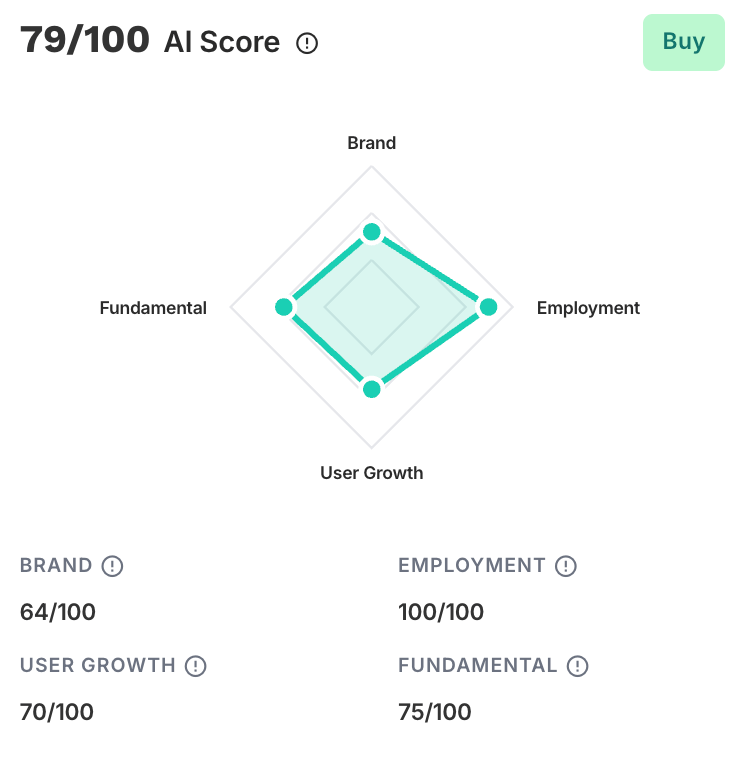

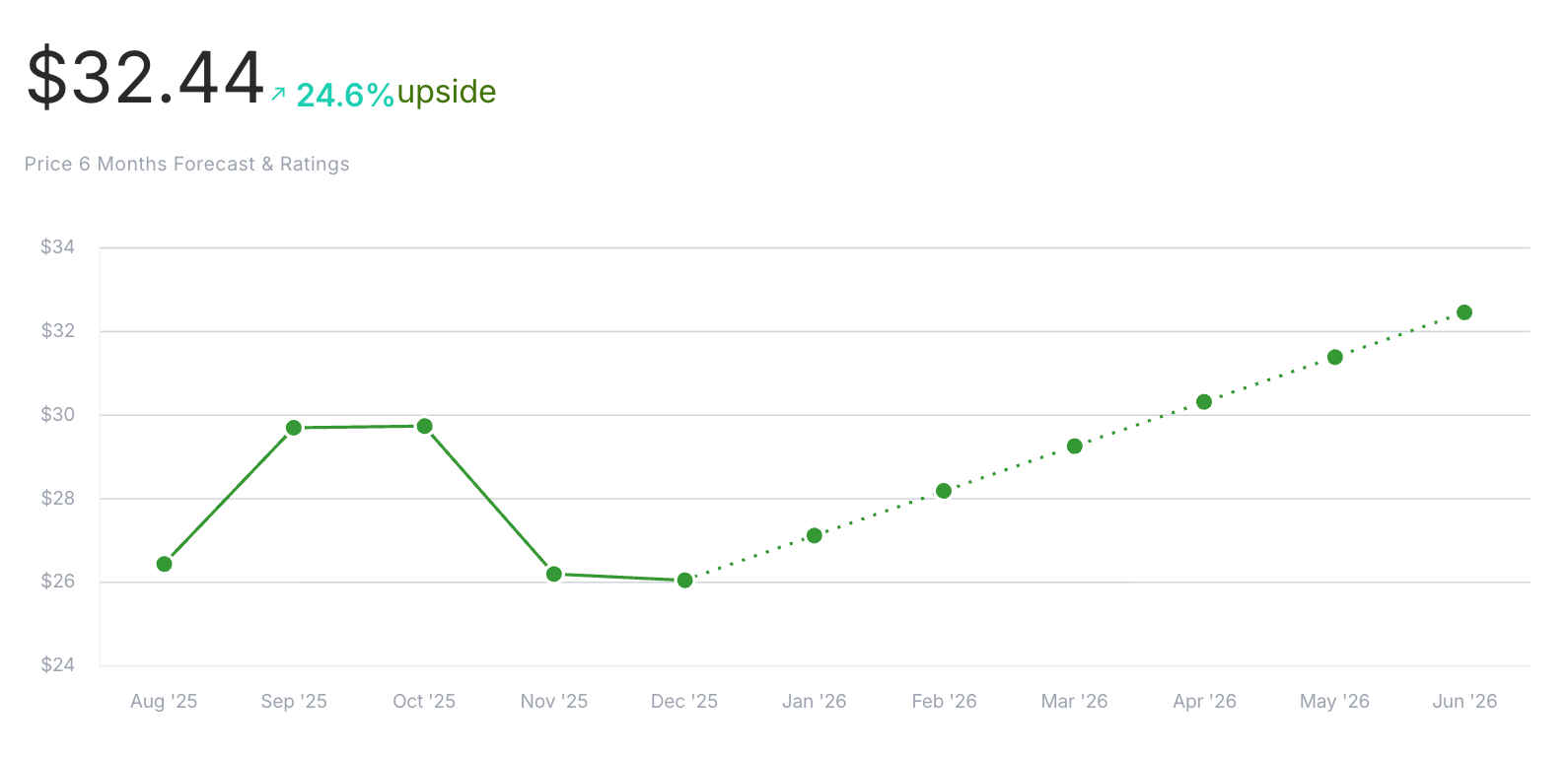

SoFi $SOFI

SoFi Technologies Inc. is a financial technology company based in San Francisco, California. It offers a comprehensive suite of financial products that range from personal loans, home loans, and student loan refinancing to investment accounts and various banking services. SoFi’s mission is to help people achieve financial independence to realize their ambitions. Through innovative technology and a member-centric approach, the company aims to revolutionize the financial services industry.

The financial data:

Revenue: $1.27B. Up 12.27% since last quarter but up 28.58% since last year

Net income: $139M. Increased by 43.31% over the past quarter and 129.47% year over year

Price momentum: The stock is down 4.58% over the past month but up 67.83% over the past year

RSI: Neutral at 54.5

P/E: High at 47.5; potentially overvalued, but also potentially an indication of strong future growth expectations

Alternative data over the past few months:

23% decrease in job listings

82% positive employee outlook (up 12%)

70% increase in lobbying cost

28% increase in web traffic

25% decrease in mobile app downloads

4% increase in X followers

Current price: $26.34

Target price: $32.44

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake of Invested Inc.

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.