Hello there.

Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best of finance from last week. Friday, we’ll cover tech, and next Monday, we’ll tackle policy.

This week, we’ve got…

🎄 The Grinch Steals Christmas (Again)

⚡️ Finance Quick Fix

🌿 Genuine High or Blowing Smoke?

🎭 Winners & Losers

😆 Meme of the Week

📈 Top Stock Ideas

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates at FinanceWrapped.com.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with Vintage Funds

There’s a reason mobile home parks are getting so much institutional love.

They remain one of the key affordable-housing sources nationally, have limited supply and high tenant retention (10-12Y). Investors can see tremendous upside with professionally-managed MHP portfolios such as Vintage Capital’s, which targets a 15-17% IRR and makes monthly distributions. Invest directly in individual deals or via a 10+ property fund. 1031s also available.

Please support our partners!

🎄 Tariffs Echo Like the Ghost of Christmas Past

Consumers are feeling about as festive as a root canal this holiday season. A whopping 41% of Americans plan to spend less on gifts this year (up 6% from last year), and 46% of those penny-pinchers blame the "high cost of goods." That's a 10-point jump from last year, when people were already complaining about prices. Even the folks spending more say they're doing it because everything costs more, not because they're feeling flush.

The vibes are genuinely terrible. 61% of Americans say prices are rising faster than their incomes, including 78% of those earning under $30,000.

But despite the gloom, there's a twist: last year's holiday sales beat expectations even as consumers complained about prices, and the National Retail Federation projects 2025 will be the first year to crack $1 trillion in holiday commerce. The gap between what people say they feel and how they actually spend remains wide—call it the ghost of the vibecession.

The average holiday hosts might take a hit (think your mall staples, like JCPenney’s and Kohl’s), but it could be a great time to take a look at some legacy discount retailers, like Costco. Oh, and 57% of Americans are carrying at least some debt into the holiday season, up 11 points from last year. Merry Christmas, here's your credit card bill.

Also, Iggy Azalea is apparently incredibly bullish in spite of all of the above, so who knows 😂

⚡️ Finance Quick Fix

JPMorgan debuted the first money market fund tokenized on Ethereum, launching the My OnChain Net Yield Fund for qualified investors.

US oil prices fell below $55 a barrel for the first time since February 2021, extending a sharp slide as US production and OPEC+ output hit records.

Bitcoin is headed for its fourth annual loss, down about 7% for the year in a decline that didn't coincide with a major scandal or industry meltdown.

Lululemon CEO Calvin McDonald will step down at the end of January, with shares rallying as much as 11% after the move was announced.

Warner Bros. Discovery is likely to reject Paramount's $108.4 billion takeover bid, with the board expected to announce a decision soon.

🌿 Genuine High or Blowing Smoke?

President Trump is "very strongly" considering reclassifying marijuana from Schedule I (alongside heroin) to Schedule III (alongside Tylenol with codeine), and the cannabis industry is losing its mind. Pot stocks surged at the end of last week after reports that Trump could sign an executive order as soon as this week. The move wouldn't legalize weed federally, but it would unlock research funding, ease tax burdens, and potentially open the door to Medicare coverage for CBD products. The global cannabis market is projected to hit $160 billion by 2032, so the stakes are enormous.

Here's where it gets interesting: Trump is reportedly considering a Medicare pilot program that would reimburse seniors for CBD to treat chronic pain and sleep issues. That's a massive deal for an industry that's been locked out of institutional capital because banks can't lend to businesses trafficking Schedule I drugs. If Medicare starts covering cannabis, Big Pharma will suddenly care about an industry they've spent decades lobbying against.

Critics are freaking out, and not without reason. The FDA has only approved one CBD drug (Epidiolex, for rare epilepsy), and it’s got sketchy reviews, but Trump's billionaire ally Howard Kessler is pushing hard for the pilot program. And as we’ve seen, nothing bends the president’s ear quite like a guy with a lot of cash. But the market doesn't care about the science or politics right now—just the green.

🎭 Winners & Losers

A lot can happen in a week!

Let’s take a quick look at who struck gold and who struck out since our last issue:

🏆 Winners

Tesla, Inc. (TSLA): +10.04%

Eli Lilly and Company (LLY): +7.34%

Meta Platforms, Inc. (META): +0.03%

Walmart Inc. (WMT): +0.31%

Berkshire Hathaway Inc. (BRK.A): +1.74%

😞 Losers

🫡 Meme of the Day

📈 Stock ideas

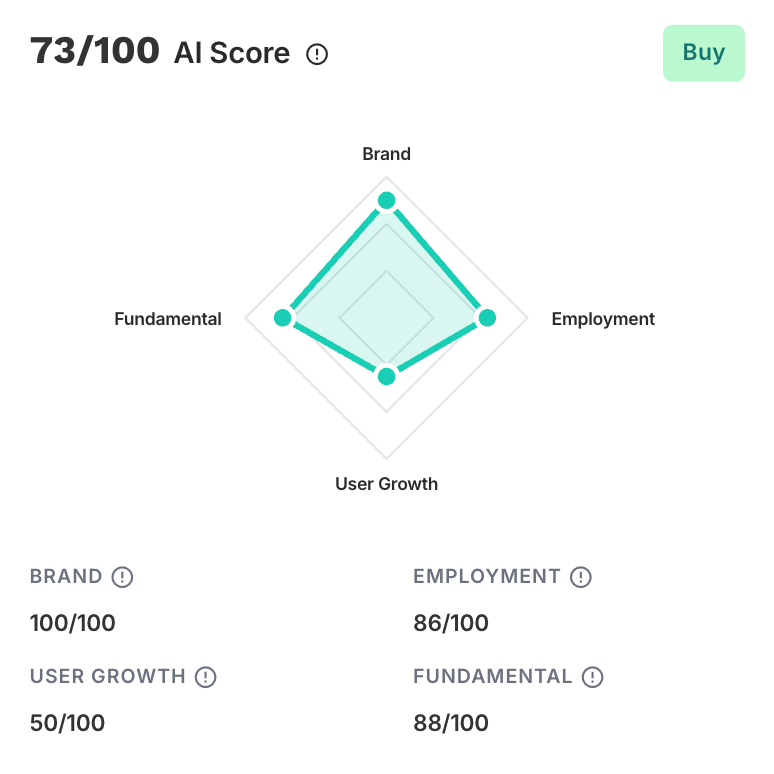

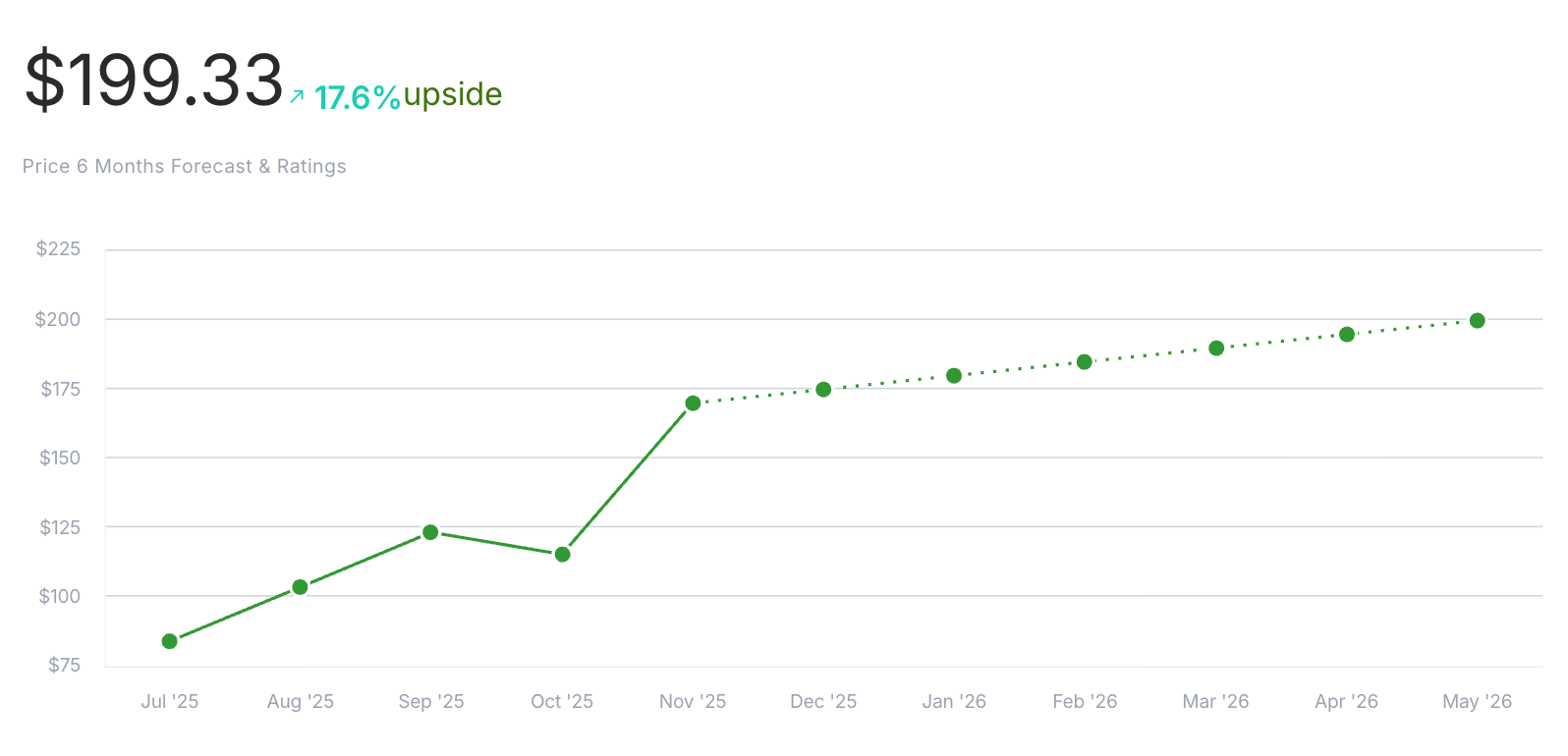

Analysis provided by altindex.com.

Remember to always DYOR.

Nutex Health $NUTX

Nutex Health Inc. operates as a healthcare services and operations company in the United States. It operates through three segments: Hospital, Population Health Management (PHM), and Real Estate.

The signals:

Revenue: $268M. That’s a 9.76% increase since last quarter and a 239.87% increase over the past year

Net income: $55M. Up 413.25% quarter over quarter and up 730.78% year over year

Price momentum: positive short-term and long-term price momentum

RSI: neutral at 62.6

P/E ratio: Quite low at 8.58. Could reflect undervaluation

Alternative data over the past few months:

114% increase in web traffic

24% increase in Stocktwits mentions

Current price: $169.57

Target price: $199.33

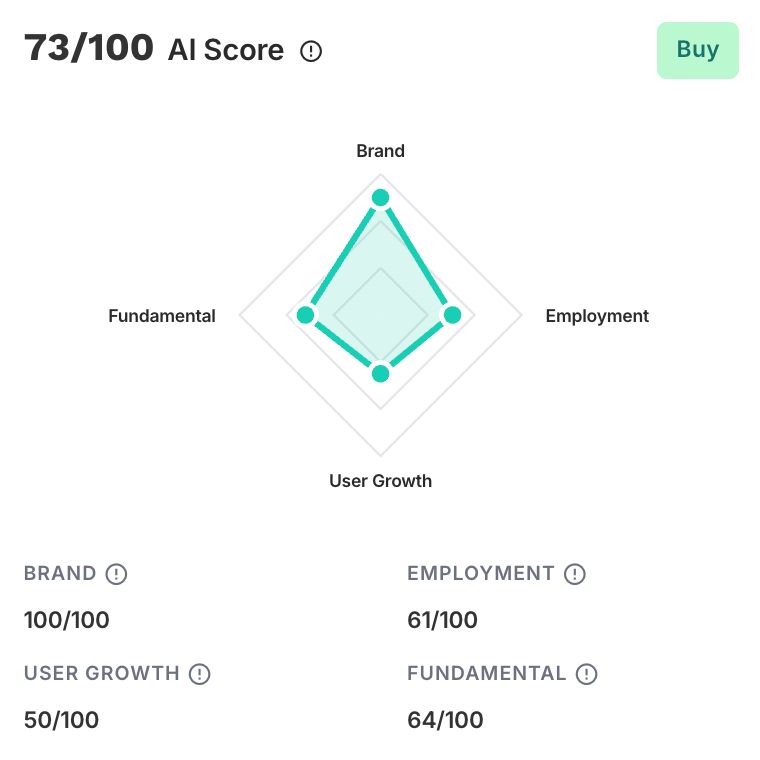

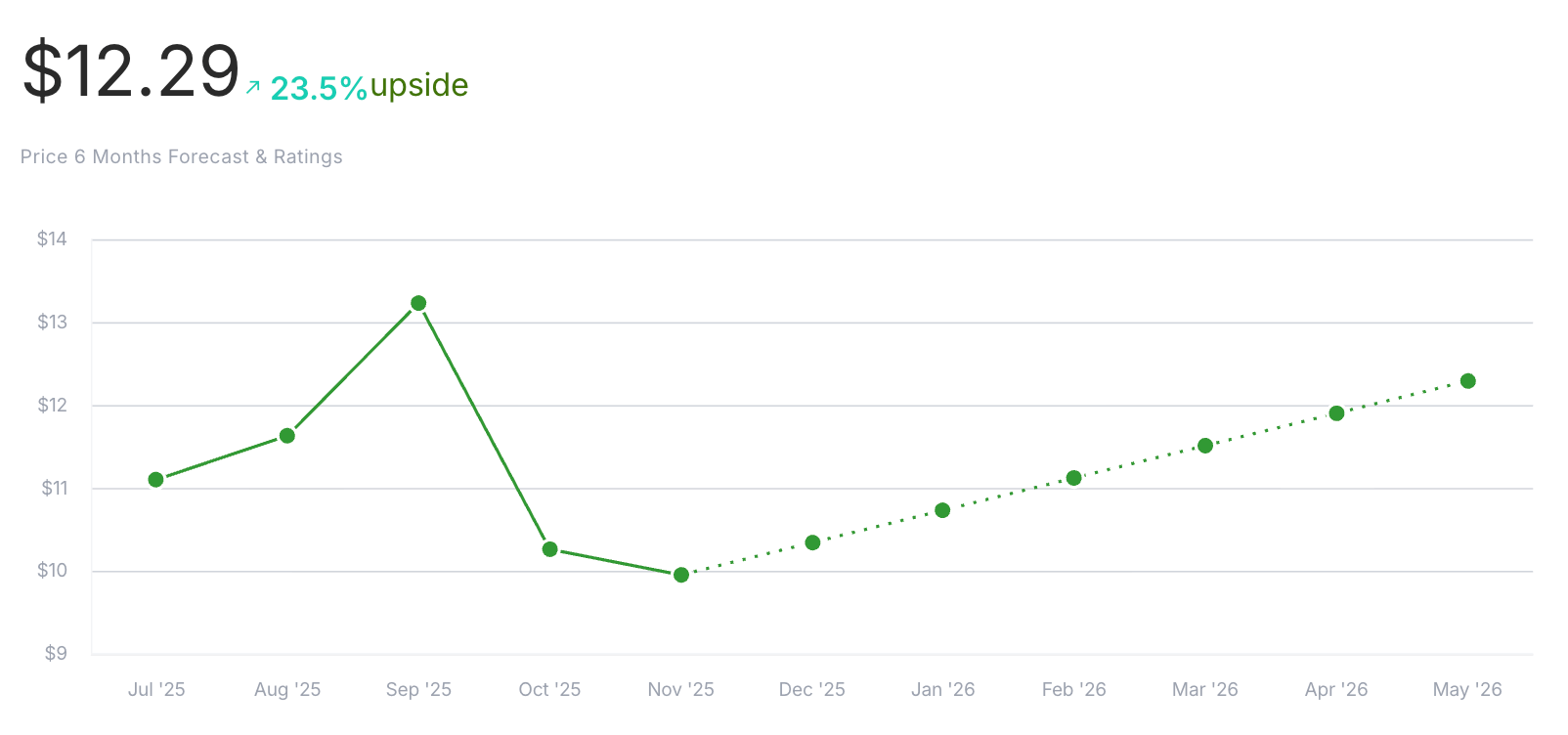

Serve Robotics $SERV

Serve Robotics is a technology-focused company specializing in autonomous delivery robots. Their key mission is to revolutionize the delivery industry by enhancing efficiency and reducing costs associated with last-mile deliveries. With a diverse portfolio of clients including retailers, restaurants, and logistics companies, Serve Robotics is positioned at the nexus of innovation in the autonomous delivery space. (Note that Serve Robotics isn’t profitable yet, which is why the company has negative net income but a positive rating; the AI is keen on its growth potential in the future.)

The signals:

Revenue: $690,000. Up 6.94% since last quarter and up 209.87% since last year

Net income: -$33M. Decreased by 58.38% over the past quarter and down by 312.97% year over year.

Price momentum: positive short-term momentum but negative long-term momentum

RSI: is neutral at 46.9

P/E ratio: N/A (company is not profitable)

Alternative data over the past few months:

100% positive employee outlook

42% decrease in web traffic

21% increase in Instagram followers

16% increase in Twitter followers

Current price: $9.95

Target price: $12.29

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake of Invested Inc.

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.