Hello there.

Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best of finance from last week. Friday, we’ll cover tech, and next Monday, we’ll tackle policy.

This week, we’ve got…

🤑 We’re So Back?

⚡️ Finance Quick Fix

🟠 Crypto’s Going Wild

🎭 Winners & Losers

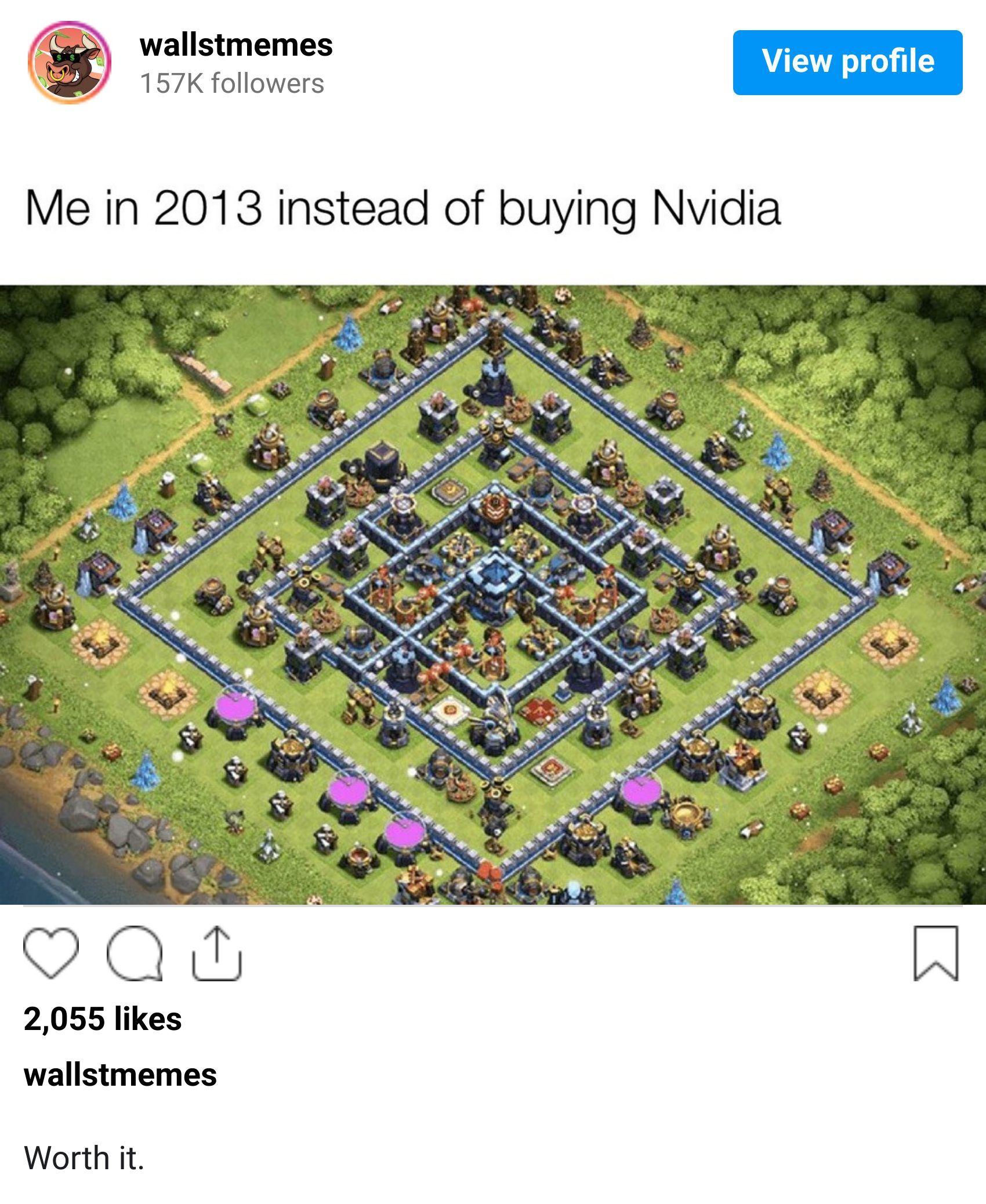

😆 Meme of the Week

📈 Top Stock Ideas

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates at FinanceWrapped.com.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with BlueAlpha

Make Every Ad Dollar Work Harder

Great measurement is pointless if you don’t act on it.

BlueAlpha is the AI Action System for Marketing, built to turn noisy data into weekly, campaign-level moves your team can actually take. Not dashboards. Not stale reports. Actions.

Every week, BlueAlpha delivers transparent, trusted recommendations your team can approve in minutes. Reallocate. Scale. Cap. Pause. All backed by Bayesian MMMs, causal tests, and explainable AI from the team that built Tesla’s growth systems.

Brands like beehiiv, MUBI, and Klover, use BlueAlpha to cut waste, compound ROI, and grow faster.

Please support our partners!

🤑 From “It’s So Over” to “We’re So Back”

Crazy week. Fed rate cut odds are at 94% for the FOMC in 7 days. Against all odds, a lot of major companies’ stocks are sitting on positive 5-day growth (check the heat map). Bitcoin just popped 11% over two days. And President Trump just said people won’t have to pay income taxes soon… We’ll see about that one.

We’re not saying that there’s no bad news, but man, for being on the edge of a market bubble, things aren’t too bad at the moment. Could change just as fast though.

Apple (AAPL) and Intel (INTC) are up on news that Intel will be making Apple’s entry-level M-series chips. Just like old times! Meanwhile Google and apparently Amazon are giving Nvidia a run for its money in chips (or at least are attempting to).

Don’t get lost in the noise, though: some stocks win and some lose in the short term, but here are the top-performing stocks of the year so far. Some won’t surprise you, but you may not have heard of others.

⚡️ Finance Quick Fix

Cyber Monday online sales hit $13.3 billion, setting a record as shoppers took advantage of BNPL, with mobile devices accounting for 55% of purchases.

Mom-and-pop business bankruptcies hit a record as debts pile up, with more than 2,200 small firms filing under Subchapter V rules this year.

Boeing is on track to generate billions in cash next year, with CFO Jay Malave projecting positive cash flow in the low single digits heading into 2026.

The SEC's new chair called for new rules for smaller companies to ‘make IPOs great again’ by reducing regulatory burdens.

Costco Wholesale has sued the Trump administration, asking the Court of International Trade to consider tariffs collected as unlawful.

🟠 Bitcoin Blasts Off

What an insane couple of days for Bitcoin. The crypto rose 11% over 48 hours, fueled by some majorly positive news:

Bank of America (BOA) just started recommending that clients put 1-4% of their portfolios into crypto. Insane.

Vanguard just listed a bunch of crypto ETFs… after years of refusing to do so. They even tweeted this nastiness about crypto back in the day. The Bitcoin ETF Vanguard added did $5.1 BILLION in volume on day one.

On top of those two catalysts, the UK passed a law recognizing crypto as property, so that’s good.

It’s strange, though; this amount of good news would have sent Bitcoin through the roof in past cycles, but it’s just settling in the $92-93K range. We’re definitely living in different times, but we’ll take the positive news.

🎭 Winners & Losers

A lot can happen in a week!

Let’s take a quick look at who struck gold and who struck out since our last issue:

🏆 Winners

Amazon.com, Inc. (AMZN): +4.49%

Apple, Inc. (AAPL): +4.12%

Microsoft Corporation (MSFT): +3.74%

Broadcom (AVGO): +1.98%

NVIDIA Corporation (NVDA): +0.54%

😞 Losers

📈 Stock ideas

Analysis provided by altindex.com.

Remember to always DYOR.

TD SYNNEX $SNX

TD SYNNEX is a leading provider of distribution, systems design, and integration services for the technology industry. The company aids customers in deploying complex IT solutions in a dynamic technological landscape. With a range of services and an extensive product catalog, the company positions itself as a critical player in the technology supply chain. Their extensive market reach and operational expertise extends well beyond North American borders, impacting global markets.

The signals:

Revenue: $15.7B. That’s a 4.71% increase since last quarter and a 6.58% increase over the past year

Net income: $227M. Up 22.64% quarter over quarter and up 27.02% year over year

Positive short-term and long-term price momentum

RSI is slightly low at 16.67; looks fairly valued

P/E ratio is high at 48.93. Could reflect overvalution

Alternative data over the past few months:

135% decrease in job postings

46% increase in web traffic

11% increase in Instagram followers

Current price: $153.08

Target price: $179.13

Solventum $SOLV

Solventum is a rapidly growing company in the healthcare services industry, showing consistent growth in key financial metrics over the past year. The company specializes in innovative solutions and has a robust portfolio that attracts a diverse range of customers. With a dedication to sustainability and strategic expansion, Solventum is well-positioned to continue its upward trajectory in the competitive market landscape.

The signals:

Revenue: $2.1B. Down 3.01% since last quarter but up 0.67% since last year

Net income: $1.27B. Increased an incredible 1,306.67% over the past quarter and up 937.70% year over year.

Positive short-term and long-term momentum

RSI is a bit low at 26; potentially slightly oversold

P/E ratio is 9.82, which is considered low and might signal undervaluation

Alternative data over the past few months:

22% increase in job postings

9% decrease in web traffic

5% increase in Twitter followers

Current price: $84.86

Target price: $99.80

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake of Invested Inc.

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.