Hello there.

Happy Friday! We’re flying high with AI now… just… don’t look down…

A lot went down at Davos this week during the World Economic Forum. It was hilarious, concerning, moving, and so many other things.

And we feel the same ways about Elon Musk’s X spat with Ryanair’s CEO 😂

This week:

🕺 Did AI Have Two Left Feet at Davos?

⚡️ SubstackTV: Who’s Tuning In?

✈️ Ryanair Hits a Little Turbulence

🤖 Google Wants to Be Your Study Buddy

🎙️ AI’s New Phase: Personal, Weird, and Everywhere

Fasten your seatbelts, this could get a little bumpy.

In partnership with AltIndex

The trading strategy that Wall Street can’t keep up with

Social arbitrage.

A trading strategy where your greatest advantages are observations about your everyday world and social media data.

We think this is THE trading strategy that will dominate in 2026 and beyond. Experts in the field describe it as observational investing, where you use social data to watch shifts in consumer behavior, trends, or culture.

This leads to an obvious question: where do you get this data? The best place we’ve found is Reddit, where people are constantly talking about new trends, topics, and specifically, stocks. You have a high chance of hearing about a new stock on Reddit first.

The problem, though: how do you sort through the thousands of comments to find consistent trends?

The answer: AltIndex processed 168,000 Reddit comments for you to arrive at these top 5 Reddit stocks, given to you for free.

Will you take advantage of the hidden data that’s sitting right in front of you?

Please support our partners!

🕺 AI Gets Down and Dirty at Davos

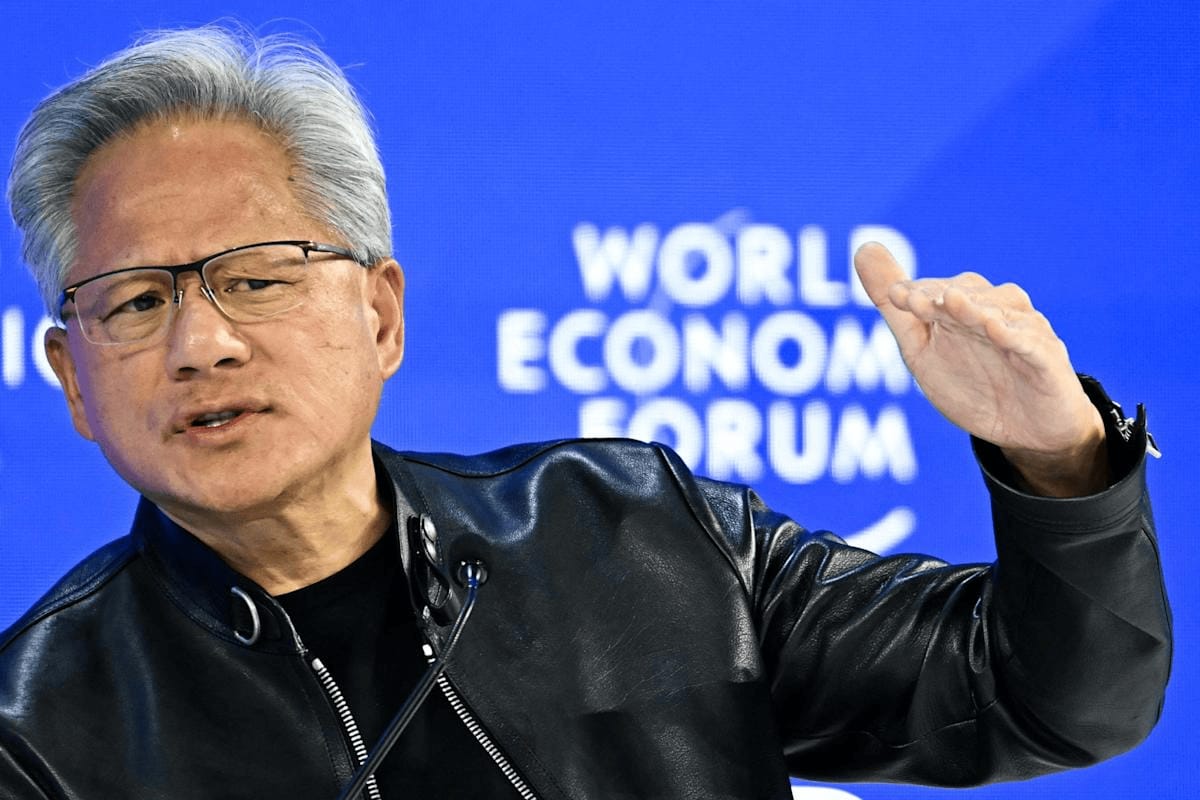

The world's richest people descended on Davos this week, and the only thing they could agree on was that AI is about to eat everything. Nvidia CEO Jensen Huang showed up to tell everyone that renting his company's GPUs is getting harder because demand is through the roof, calling the AI buildout "the single largest infrastructure buildout in human history." Translation: keep buying the dip on chip stocks, nerds.

Also, we got this new meme from French President Emmanuel Macron:

But not everyone's popping champagne. JP Morgan boss Jamie Dimon dropped a reality check, warning that AI "may go too fast for society" and could cause actual civil unrest if 2 million truckers suddenly find themselves competing for $25k jobs instead of $150k ones. His solution? Phase it in to "save society" and maybe throw some retraining programs at the problem before the pitchforks come out.

(Also also, update: the US isn’t going to take Greenland by force. They’ll prob just buy a few pieces of it.)

Meanwhile, Alphabet quietly became the first Big Tech company to show Wall Street what "measurable AI returns" actually look like. Apple confirmed Gemini will power Siri (RIP to whatever Siri was before), and Walmart's using it for AI-powered shopping and drone delivery. The stock hit $4 trillion market cap. Investors are happy to ignore their existential AI questions as long as earnings keep expanding.

🎤 What do you think?

Is AI really going to take all of our jobs?

⚡️ The Tech Ticker

Substack is launching Apple TV and Google TV apps for video and livestream content, drawing frustration from writers.

Lemonade launched an insurance product for Tesla FSD users that promises to cut per-mile rates by roughly 50%.

Snapchat added new parental insights to Family Center, including time breakdowns by feature and "trust signals" that rank friends.

Tiger Global and Microsoft are set to fully exit PhonePe through the startup's IPO, which is targeting a $15 billion market cap.

Have I Been Pwned says 72.7 million Under Armour accounts were hit in a ransomware attack, though the sportswear brand has stayed silent on the breach.

✈️ Billionaires Beef at 30,000 Feet

Elon Musk and Ryanair CEO Michael O'Leary spent the week calling each other idiots on the internet, and naturally, both of their shareholders are winning.

The drama started when O'Leary rejected Starlink for Ryanair's fleet, saying it would cost $200-250 million between the service and aerodynamic drag on short-haul flights. Musk fired back that Ryanair would lose customers to airlines with Wi-Fi. O'Leary told Irish radio that people should ignore Musk because he's a "very wealthy" idiot. Musk then called O'Leary an "utter idiot" who should be fired and floated the idea of buying Ryanair just to install someone named Ryan to run it.

But somehow, both "idiots" have absolutely crushed it for investors. Ryanair has returned 16% annually since going public in 1997, while other airlines rotated through bankruptcy court. Tesla has returned 43% per year since its 2010 IPO. Ryanair's stock actually went up during the spat, because nothing says "buy signal" quite like free publicity from the world's richest man. (Tesla’s stock is up as well, but not from the Ryanair spat. It was Elon posting a video claiming Robotaxis will start driving without a safety monitor.)

O'Leary held a press conference on Wednesday to address the feud. No word yet on whether Musk will actually make a bid, but if history is any guide, he'll probably tweet about it seventeen more times before moving on to his next target. Honestly, we can’t wait 😂

🤖 All Eyes on AI

Gemini now offers free SAT practice exams through a partnership with The Princeton Review, while Khan Academy will use the AI to power its Writing Coach.

Google DeepMind is hiring Hume AI's CEO and top engineers as part of a licensing deal to integrate emotional intelligence into Gemini's voice capabilities.

Spotify rolled out AI-powered Prompted Playlists in the US and Canada, allowing Premium users to build playlists using detailed, conversational prompts.

DeepMind CEO Demis Hassabis said he was "a little bit surprised" OpenAI moved so fast on ads, adding that Gemini currently has no such plans.

Waymo launched autonomous ride-hailing in Miami, covering a 60-square-mile service area and bringing its total to six U.S. cities with driverless operations.

🤡 Meme of the Week

🎙️ AI’s New Phase: Personal, Weird, and Everywhere

In this episode, TWIT unpacks why Claude isn’t just another AI model; it’s the front door to a new era of ultra-personalized, vibe-coded software that’s reshaping how builders and normal users interact with technology heading into 2026.

📻 Tune in to:

See how Claude’s rise signals a shift from generic AI tools to deeply personalized “coworker” software, and why coders and normies are suddenly obsessed.

Understand the growing backlash and regulatory pressure around AI, from Grok’s deepfake and “undressing” scandals to global crackdowns.

Connect the dots between algorithmic culture, creator inequality, and the weird future we’re drifting into.

🎧 Listen on:

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Finance Wrapped, AltIndex by Invested Inc. (AltIndex LLC), Stocks & Income, The Chain, Future Funders, and Dinner Table Discussions are all owned by Invested Inc.