Hello there.

Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best of tech from the past week. Every Monday, we’ll tackle policy, and every Wednesday, we’ll recap finance.

This week, on Tech Wrapped, we’ve got…

👑 Recrowning the Once and Future King

⚡️ The Tech Ticker

😬 AI’s in a Tight Spot

🤖 All Eyes on AI

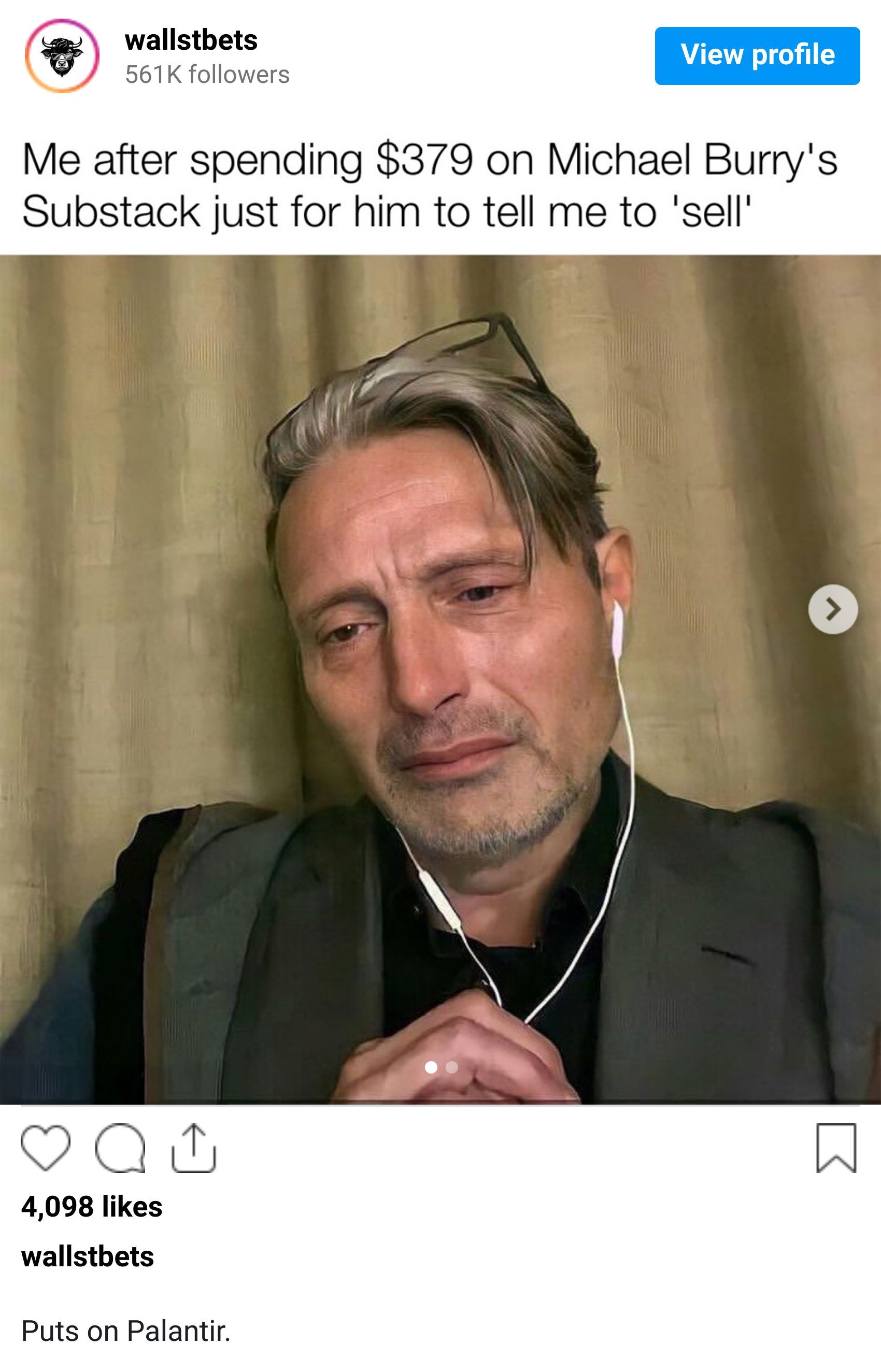

😆 Meme of the Week

🎙️ Lulu’s Feud & The Age of Top‑Gun Traders

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates on Finance Wrapped.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with Roku

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Please support our sponsors!

👑 Long Live The King

Well, that was fast. The stock market seems to have crowned a new AI king, and it's not who you think. Google, once the laggard, is now being priced like the leader thanks to its Gemini 3 model and custom TPU chips, fueling a rally in both Alphabet and its chip-making partner, Broadcom.

The heat sent OpenAI scrambling into a "code red." CEO Sam Altman slammed the brakes on new products to fix ChatGPT's wobbly performance. To make matters worse, its blockbuster $100 billion deal with Nvidia is apparently still just a handshake agreement. They haven’t even signed the dang thing.

Meanwhile, Amazon is playing its own game. It's quietly arming its massive AWS cloud business with practical AI tools for enterprise clients and building chips that are apparently more cost effective than Nvidia’s, proving the AI war is being fought on multiple, less flashy fronts. It’s also announced 30 minute Amazon Prime deliveries. Hello.

⚡️ The Tech Ticker

Eric Trump's cryptocurrency firm tumbled nearly 40% in less than 30 minutes as American Bitcoin Corp shares dropped from $2.39 to $1.90.

Bending Spoons agreed to buy Eventbrite for $500 million, paying 1.7x trailing revenue for the events marketplace that was worth $1.76 billion at its IPO.

The US government will inject up to $150 million into xLight, a semiconductor startup developing particle accelerator-powered lasers.

A self-driving Waymo taxi drove a passenger into the middle of a police standoff in LA.

Waymo also started testing autonomous vehicles in Philadelphia with human safety monitors and will expand trials to Baltimore, St. Louis, and Pittsburgh.

Target's website now discloses algorithmic pricing after a New York law required businesses to reveal when personal data sets prices.

😬 AI's Dot-Com Echo

As AI valuations hit nosebleed levels, Wall Street's professional party-poopers are getting flashbacks. Famed short-seller Jim Chanos is calling out debt-fueled defaults, while "Big Short" legend Michael Burry compares Nvidia's hype cycle to Cisco's right before the dot-com bust.

The skepticism centers on what critics call "circular" financing. Nvidia just dropped $2 billion into chip designer Synopsys, a move that looks like either a brilliant ecosystem play or just funneling cash to a partner so they can buy more Nvidia chips. You decide.

This financial drama is unfolding against a backdrop of insane physical demand. Data center energy needs are projected to nearly triple by 2035. That kind of infrastructure buildout will require mountains of cash and could seriously strain power grids, creating a whole new set of risks for investors to worry about.

🤖 All Eyes on AI

Amazon launched Nova Forge, letting cloud clients customize AI models midway through training for $100,000 annually.

ChatGPT referrals to retailer mobile apps increased 28% year-over-year on Black Friday weekend, with Amazon capturing 54% of referrals.

Amazon unveiled "frontier agents" capable of handling multi-day projects without constant human involvement at AWS re:Invent.

Amazon's Rufus AI chatbot drove 5x higher conversion rates on Black Friday, converting at 100x higher than regular browsing.

Apple's AI chief, John Giannandrea, stepped down after seven years as the company scrambles to catch up with AI rivals.

🎙️ Lulu’s Feud & The Age of Top‑Gun Traders

This episode of The Best One Yet unpacks Lululemon’s founder publicly roasting his own CEO, the shocking rise of crypto‑hungry soldiers on U.S. military bases, and how AI agents quietly orchestrated a quarter of all Black Friday purchases.

📻 Tune in to:

Learn why Lululemon founder Chip Wilson dropped a full‑page Wall Street Journal diss track on his successor.

Hear how Air Force bases unexpectedly dominate the list of America’s top crypto‑holding zip codes.

Discover how AI “shop bots” sourced 25% of all online Black Friday spending, and how retailers are about to get punished for even thinking about raising prices.

🎧 Listen on:

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.