Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week:

💰 5% of GDP Is Aimed At Interest

🤖 Nvidia Plans to Build Big in Boston

🎮 Gamestop Cashes in on Collectibles

🧬 23andMe’s DNA Vault Is up for Grabs

💻 Adobe CFO Once Again Eyes the Dip

🔬 AI Spots Cancer With Uncanny Accuracy

🤔 3 stocks to consider

With how quickly the market and investment climate is changing right now, we can’t afford to not stay up to date… You can always read the latest and most relevant finance news & updates at FinanceWrapped.com.

💰 Global Debt Service Costs Hit 16-Year High

Nations are now spending 3.3% of their GDP on debt service costs, surpassing defense spending and reaching levels not seen since before the 2008 financial crisis.

The US leads with a staggering 4.7% of GDP going to interest costs. Nearly half of OECD sovereign debt will need refinancing by 2027, forcing governments to issue bonds at much higher rates.

🤖 Nvidia Jumps Into Quantum Computing Race

Tech giant Nvidia announced plans to expand beyond AI with plans to build a cutting-edge quantum computing research facility in Boston.

The facility will focus on breakthrough quantum technologies while integrating them with AI supercomputers powered by Nvidia's latest Blackwell GPUs.

🎮 GameStop's Collectibles Near Gaming Revenue

GameStop's transformation continues as its collectibles segment approaches parity with traditional gaming sales.

Collectibles revenue hit $270 million last quarter, exceeding analyst expectations of $216 million and marking the third consecutive quarter of sequential growth.

🧬 23andMe Bankruptcy Puts DNA Up For Auction

In a concerning development for privacy advocates, 23andMe's bankruptcy proceedings have put the genetic data of 15 million customers up for potential auction.

The company's May 14 auction will include its vast genetic database, described as "one of the world's largest crowdsourced platforms for genetic research."

💻 Adobe CFO Bets Big on Company's AI Future

Adobe's CFO Dan Durn has made his second major stock purchase since joining the company, investing over half a million dollars amid a 20% stock decline.

The move mirrors his successful September 2022 purchase, which preceded an 80% stock surge in 2023. The company expects to double its AI-driven recurring revenue over the next three quarters.

🔬 AI Achieves 99% Cancer Detection Accuracy

A groundbreaking AI model called ECgMLP has achieved 99.26% accuracy in detecting endometrial cancer, significantly outperforming human specialists' 78-81% accuracy rate.

The model's success extends beyond endometrial cancer, with impressive detection rates for colorectal, breast, and oral cancers.

Stock ideas

Here are three of my favorites from this past week.

Analysis provided by public.com.

Remember to always DYOR.

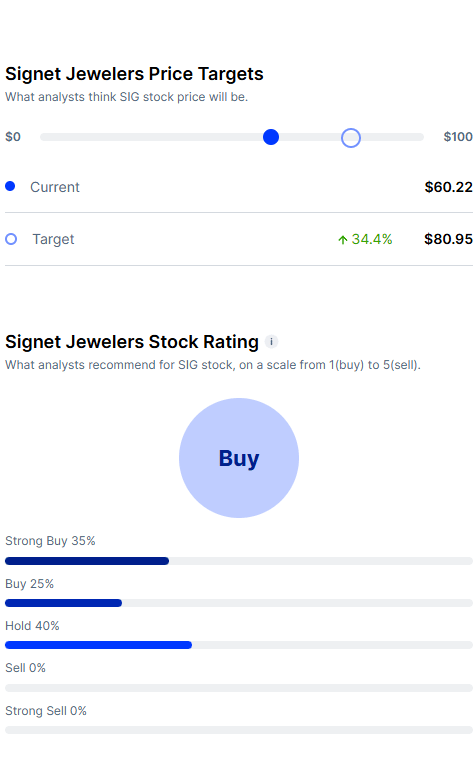

Signet Jewelers

(SIG)

Bullish Case

Strong Free Cash Flow Generation: Signet generated $438 million in free cash flow in FY25, converting 88% of adjusted operating income into cash.

Aggressive Share Repurchase Program: With $723 million remaining in its buyback authorization and a 17% FCF yield, Signet could retire 6-7 million shares annually.

Strategic Repositioning for Growth: Signet is reorganizing around four key brand clusters and shifting 200 stores to higher-traffic off-mall locations.

Bearish Case

Lab-Grown Diamond Disruption: The rising popularity of lab-grown diamonds is pressuring pricing and potentially cannibalizing traditional diamond sales.

Recent Impairment Charges: Signet recorded $369.2 million in impairment charges for digital brands in FY25.

Euronet Worldwide (EEFT)

Bullish Case

Omnichannel Remittance Leadership: Euronet combines cash-based and digital remittances through Ria Money Transfer.

Impressive Long-Term Growth: EEFT has compounded revenue, operating income, and EPS at a 15% CAGR over 30 years.

Attractive Valuation with Strong Insider Alignment: Insider value is high, trading at just 10.1x forward P/E with a 13.9% FCF yield.

Bearish Case

Competitive Digital Pressure: Ria faces intensifying competition from pure-play digital disruptors like Wise and Remitly.

ATM Business Declining Relevance: ATMs now contribute just 19% of revenue (down from 25% in 2019), reflecting a broader shift away from cash.

Encore Capital Group (ECPG)

Bullish Case

Debt Collection Market Leadership: As a global debt purchaser and collector, Encore benefits from economic downturns when consumer debt levels rise.

Significant Insider Confidence: Recent substantial insider purchases signal management's belief in the company's undervaluation and future prospects.

Digital Collection Transformation: Encore is using technology and analytics to improve collection efficiency and reduce operational costs.

Bearish Case

Regulatory Risk Exposure: Debt collection businesses face ongoing regulatory scrutiny and potential legislative changes that could restrict collection practices.

Limited Growth Visibility: Without detailed financial projections available in the source material, investors face uncertainty about Encore's growth trajectory.

💙 That’s a wrap

Share this newsletter with your friends & family to make sure they’re keeping up with the rapidly-changing investment climate.

Disclosures

There are affiliate links above; we'll get a couple of bucks if you take action after you click.

Nothing above is financial advice