Hello there.

Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best of tech from the past week. Every Monday, we’ll tackle policy, and every Wednesday, we’ll recap finance.

This week, on Tech Wrapped, we’ve got…

🚀 Too Much Data, Not Enough Space

⚡️ The Tech Ticker

🧠 Meta Can’t Quite Grasp the Big Picture

🤖 All Eyes on AI

😆 Meme of the Week

🎙️ Lulu’s Feud & The Age of Top‑Gun Traders

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates on Finance Wrapped.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with Stocks & Income

Stop Guessing. Get Market Signals That Beat The Street.

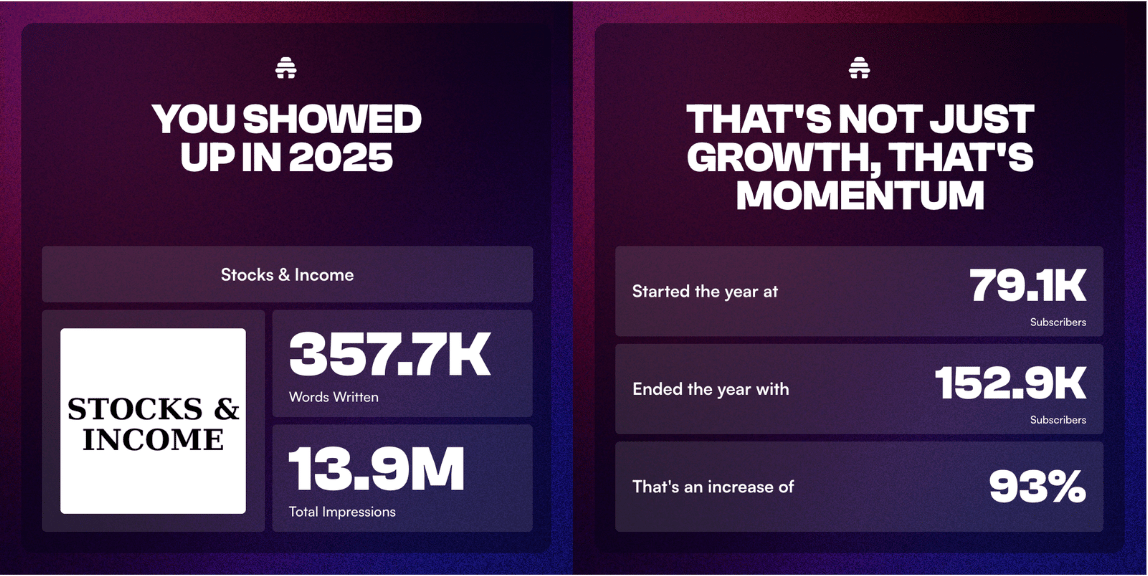

Our partner newsletter, Stocks & Income, has just posted a massive 2025: growing its readership to 150K this year alone.

Why are people reading it? It’s simple. They give you pro-level market intelligence every single morning (at the opening bell) absolutely free.

That's it. That's the deal. They run their operation like a wirehouse research desk, delivering maximum value to their subscribers.

The results speak for themselves. This year, S&I pointed readers to CoreWeave and Palantir just as institutional capital was flowing in. They are dedicated to helping you find those opportunities first.

They send you everything from Congress trading activity to crucial earnings results to untapped Reddit social sentiment data. If it moves the market, you’ll know.

Stocks & Income is leveling up their research in 2026. Don't miss out on the daily intelligence that tens of thousands of investors are already relying on.

Please support our sponsors!

🚀 Data Centers Are Getting a Bit Out There

The AI arms race just left the planet. Jeff Bezos and Elon Musk are now competing to build data centers in orbit, betting that 24/7 solar power and zero weather interruptions will make off‑world computing cheaper than anything on Earth. Bezos’ Blue Origin and Musk’s SpaceX are pitching investors on the idea that the next trillion‑dollar infrastructure play might not even have gravity.

Oh, and Elon Musk is planning have SpaceX go public next year at a $1.5T market cap. No big deal, bro. Just the richest man on earth doing the the largest IPO of all time, bro.

Back on the ground, Oracle’s stock dropped 11% after missing revenue expectations, dragging Nvidia and AMD down with it. The selloff showed how twitchy the AI trade has become: one weak quarter from a cloud heavyweight and suddenly everyone’s questioning the “AI buildout.” Oracle’s $50 billion in projected capital expenditures and negative $10 billion free cash flow didn’t help.

Still, the long‑term thesis stands. Demand for compute keeps exploding, and the companies building the hardware, chips, and infrastructure (whether in Louisiana or low orbit) are shaping the next decade of returns.

⚡️ The Tech Ticker

YouTube TV will launch genre-based subscription plans in early 2026, breaking up its $82.99 cable-like bundle for the first time.

IBM announced it is acquiring Confluent in a deal worth $11 billion, paying $31 per share in cash for the data streaming platform.

Security flaws in Freedom Chat exposed users' phone numbers and PINs, with a researcher finding nearly 2,000 compromised users and leaked PIN codes.

Binge-watching late-night TV shows causes market returns to decline the following day, according to research from Hong Kong University Business School.

A pregnant woman gave birth inside a Waymo after the company's remote team detected unusual activity and called 911.

🧠 Meta’s AI Identity Crisis

Meta’s AI strategy is starting to look like a group project gone sideways. After spending $14.3 billion to poach Scale AI’s founder , Alexandr Wang, and his team, Mark Zuckerberg’s empire is now split between the old guard optimizing ad clicks and a new lab chasing “godlike” superintelligence. The result: layoffs, 70‑hour weeks, and a model codenamed Avocado that’s still not ripe. However, deciding to FINALLY cut metaverse spending did wonders for the stock lol.

Meta’s internal chaos lands as Nvidia denies reports that China’s DeepSeek is using smuggled Blackwell chips, and Wall Street starts hedging its AI exposure for 2026. Strategists expect only a 6% S&P 500 gain next year, with JPMorgan’s David Kelly calling it a “year of risk reduction.” We’re seeing the shift from hype to hedging; AI’s still hot, just not untouchable.

Meanwhile, Palantir scored a $448 million Navy initiative to speed up submarine production, proving government AI spending is still full steam ahead. For the average investor, the playbook is changing: less moonshot, more margin. We’ve said it before, and we’ll say it again: Picks and shovels, people, not chips.

🤖 All Eyes on AI

Rivian turned to AI and autonomy to woo investors as EV sales stall, hosting its first Autonomy and AI Day to showcase in-house software.

Google updated its AI try-on feature to work with just a selfie, using its Gemini 2.5 Flash Image model to generate full-body virtual clothes try-ons.

State attorneys general warned Microsoft, OpenAI, Google, and other AI giants to fix delusional outputs, demanding transparent third-party audits.

Deutsche Bank asked its dbLumina model to help average investors track ETF funds, feeding it a week of daily market analyses over the next year.

Google promoted Amin Vahdat to chief technologist for AI infrastructure, elevating the veteran who built the company's custom TPU chips.

🤡 Meme of the Week

A quick compilation of Warren Buffett’s right-hand man Charlie Munger being unhinged, as the kids say these days:

🎙️ Space Datacenters and the New Open-Source China

This episode of This Week in Tech tears into the myth of a booming Black Friday, the tech misfires hitting America’s biggest defense darlings, and why China is suddenly the world’s unexpected champion of “open” AI models.

📻 Tune in to:

Learn why Black Friday’s online “growth” is mostly sticker-shock math, boosted by inflated prices and AI shopping assistants quietly gaming the numbers.

Hear how Trump’s Silicon-Valley-friendly AI agenda is running straight into a wall of populist backlash — from both parties.

Get the inside look at Anduril’s weapons-tech stumbles, Ford’s potential retreat from the F-150 Lightning, and why space-based datacenters are an orbital money pit.

🎧 Listen on:

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

Stocks & Income, AltIndex, Finance Wrapped, The Chain, and Future Funders are all owned by Invested, Inc.