Hello there.

Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best of policy from the past week. Every Wednesday, we’ll wrap up finance, and every Friday, we’ll take on tech.

This week, we’ve got…

💰 There’s Nothing More Patriotic Than a Tax Break

⚡️ The Policy Pulse

🏠 Should Fannie Mae Run Free Again?

₿ The Coin Toss

😆 Meme of the Week

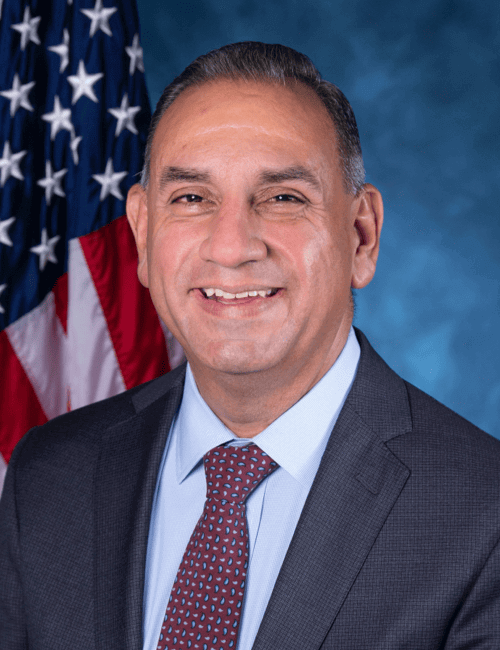

🏛 Political Portfolio Spotlight: Rep. Gilbert Ray Cisneros, Jr. (D-CA)

With how quickly the market and investment climate are changing right now, we can’t afford to fall behind. You can always read the latest and most relevant finance news & updates at FinanceWrapped.com.

And for daily deep dives covering everything from stocks and crypto to trade relations, AI investment signals, and more, subscribe to our daily newsletter Stocks & Income.

In partnership with Outskill

Over 60% of financial professionals worldwide now use AI tools to analyze markets, automate research, and make faster, data-driven decisions. Those who master AI today can capture opportunities, stay ahead of trends, and monetize their skills before the market catches up.

AI empowers you to make smarter, faster decisions and uncover opportunities most investors overlook. Learn it strategically: master the tools, workflows, and use cases shaping the future of finance, technology, and business.

Join the World’s First 16-Hour LIVE AI Upskilling Sprint, designed to make you an AI Generalist who can build, automate, and monetize with AI. Register Now (Only 500 FREE seats left)

Date: Saturday and Sunday, 10 AM - 7 PM.

Rated 4.9/5 by global learners – this will truly make you an AI Generalist that can build, solve & work on anything with AI.

In just 16 hours & 5 sessions, you will:

✅ Master 10+ AI tools & LLMs to track economic indicators, spot global trends, and forecast market movements

✅ Build & deploy AI-powered systems to automate research, reporting, and economic analysis—in days, not months

✅ Create AI agents that monitor currencies, commodities, inflation data, and policy changes—saving 20+ hours a week

✅ Generate professional-grade reports and dashboards for finance, policy, or corporate strategy

✅ Monetize your expertise: consult for businesses, advise on economic strategy, or develop AI-driven analytics solutions

All by global experts from companies like Amazon, Microsoft, SamurAI and more. And it’s ALL. FOR. FREE. 🤯 🚀

Day 1: 3000+ Prompt Bible

Day 2: Roadmap to make $10K/month with AI

Bonus: Your Personal AI Toolkit Builder

Please support our partners!

💰 From "Made in USA" to “Please Stay in the USA”

Gold prices just took their biggest nosedive in three months, dropping 2.5% to $3,404.70 per ounce after Trump clarified that gold wouldn't face new tariffs. It’s the sad fate of safe havens; the steady, old reliable that gets forgotten til the going gets tough.

Meanwhile, American support for "Made in USA" products has dropped 10% since 2022. Apparently, patriotism has a price tag, and it's getting too expensive. The biggest drop came from Americans 55 and older, whose loyalty to US-made products plummeted from 69% to 47%. Earnings for Walmart, Target, Home Depot, Lowe’s, and more retailers are coming out this week, too, which will paint a fuller picture of how tariffs are affecting large importers of consumer goods.

But Congress is trying to keep tech jobs from fleeing overseas with a revived R&D tax provision that lets companies immediately deduct US-based research expenses. At the same time, Google $GOOG and $META employees are pouring cash into a mayoral campaign that could make New York a tougher place for their own companies to operate. The irony is almost too rich.

⚡️ The Policy Pulse

Intel stock jumped following reports of potential Trump administration acquisition of a stake in the company.

US consumer sentiment unexpectedly fell this month as inflation expectations climbed amid lingering anxiety about the impact of tariffs.

Trump narrowed his search for Powell's replacement to "three or four names" after reports suggested up to 11 candidates were under consideration.

Trump announced that semiconductor tariffs will be implemented within two weeks and could reach 300%.

US import prices rebounded 0.4% in July, driven by higher consumer goods costs, suggesting exporting nations aren't cutting prices to offset tariff impacts.

In partnership with Shutterstock

AI leaders only: Get $100 to explore high-performance AI training data.

Train smarter AI with Shutterstock’s rights-cleared, enterprise-grade data across images, video, 3D, audio, and more—enriched by 20+ years of metadata. 600M+ assets and scalable licensing, We help AI teams improve performance and simplify data procurement. If you’re an AI decision maker, book a 30-minute call—qualified leads may receive a $100 Amazon gift card.

For complete terms and conditions, see the offer page.

Please support our partners!

🏠 Fannie Mae Get Her Freedom Back

The Trump administration is prepping to take mortgage giants Fannie Mae and Freddie Mac public in a blockbuster offering that could value them at a combined $500 billion. After 17 years as government wards, these mortgage behemoths might finally get their freedom papers, and investors might get a piece of the action.

This move comes as Hong Kong's IPO market is experiencing its own renaissance after years of playing dead. Chinese companies are suddenly flooding the city with billions in listings, and it looks like they’re ready to go toe-to-toe with the young wolves in the West.

₿ The Coin Toss

Citigroup is weighing custody and payment services for stablecoins and crypto ETFs as Congressional legislation sparks corporate interest in stablecoins.

Crypto ATM limits and bans are increasing across the US, with cities like Spokane banning machines entirely, while others impose transaction limits.

New York lawmakers proposed a tax of 0.2% on digital asset transactions to fund school substance abuse prevention and intervention programs.

Google Play Store is now mandating government licenses for crypto wallet apps in 15 jurisdictions, including the US, UK, and EU.

SEC Chair Paul Atkins said the agency would shift energy "from the courtroom to the policy drafting table" after ending its five-year legal battle with Ripple Labs.

😆 Meme of the Week

🏛 Political Portfolio Spotlight

Elected officials have had a tremendous amount of success in the market recently.

I want to keep you updated on what they’re trading and when—so you can leverage that intel as you plan out your own portfolio.

Analysis provided by quiverquant.com.

Remember to always DYOR.

Rep. Gilbert Ray Cisneros, Jr. (D-CA)

💲 Top Trades This Week:

[BUY] CoStar Group Inc. (CSGP)

[BUY] Dayforce Inc. (DAY)

[BUY] Revvity Inc. (RVTY)

[SELL] Boston Scientific Corp. (BSX)

[SELL] W. R. Berkley Corp. (WRB)

[SELL] Medpace Holdings Inc. (MEDP)

[SELL] Avantor Inc. (AVTR)

🔍 Analysis:

Cisneros filed seven trades this week, trimming a cluster of healthcare names while adding software and data exposure through CoStar and Dayforce, and a life sciences tools position in Revvity.

The pattern reads as a selective rotation: reduce medtech, CRO, and insurance risk and redeploy into durable software models and research tools ahead of the fall earnings run. Ticket sizes suggest incremental rebalancing rather than a strategic overhaul, but the tilt favors quality software and picks within healthcare with clearer secular demand.

🎙 Tell Us Your Thoughts

⭐️ What did you think of today's edition?

That’s all for today. Write us and let us know your thoughts on the market, the newsletter, or the weather—we’d just love to hear from you.

Till next time,

— Brandon and Blake

Disclosures

The information provided in Finance Wrapped is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. Finance Wrapped is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.